How To Calculate Cash Flow For Npv - Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the present value of all future cash flows of a project. Unlike the npv function in. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel.

Net present value (npv) is the present value of all future cash flows of a project. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Unlike the npv function in. Net present value is a financial metric used to determine the value of an investment by calculating the difference.

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the present value of all future cash flows of a project. Unlike the npv function in. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel.

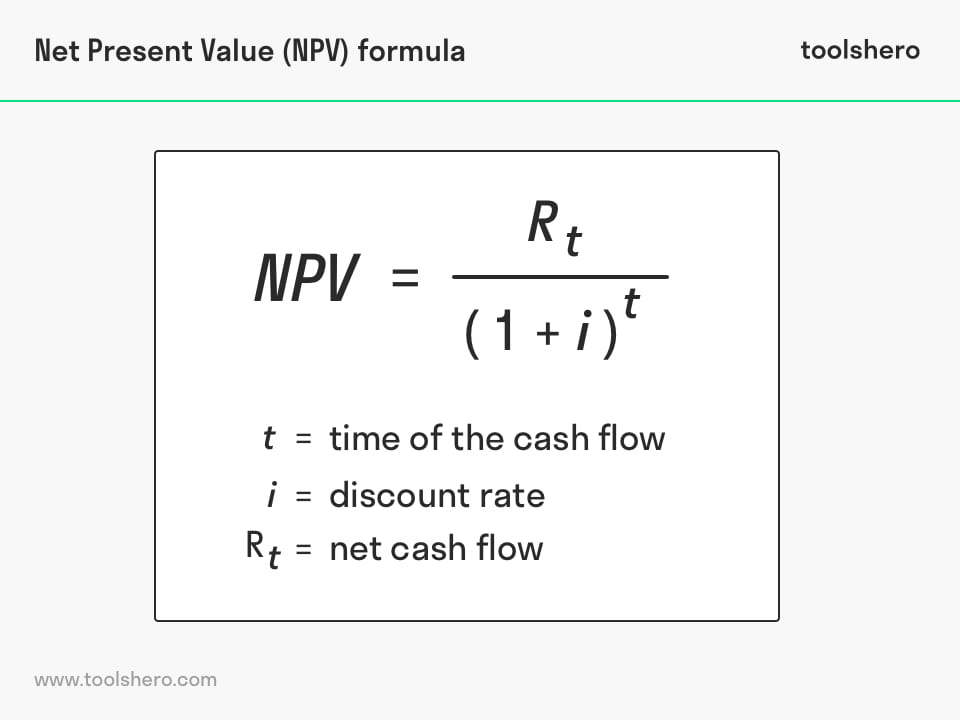

Net Present Value formula and example Toolshero

To calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Net present value (npv) is the present value of all future cash flows of a project. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Unlike the npv function in.

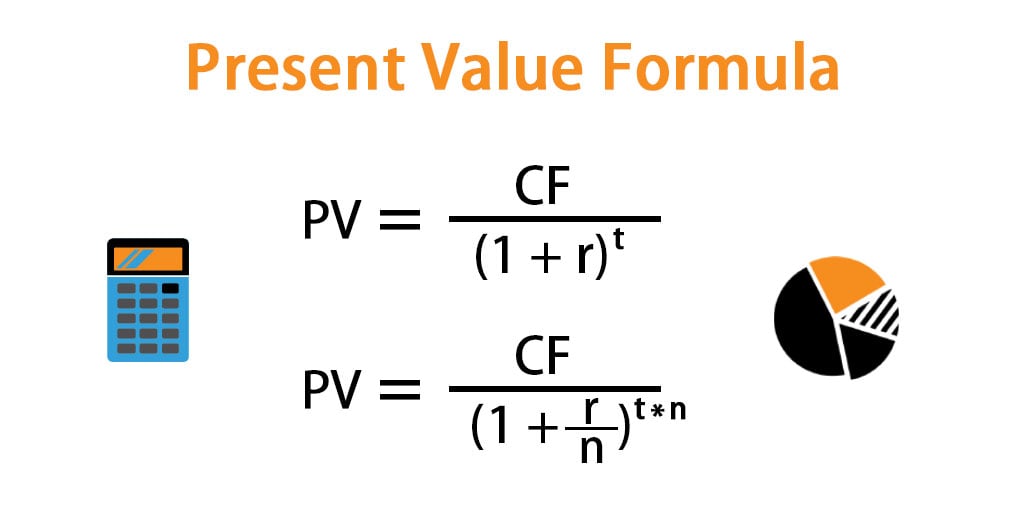

Continuous Money Flow Total and Present Value Wilson Whamess

Net present value (npv) is the present value of all future cash flows of a project. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Unlike the npv function in. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel.

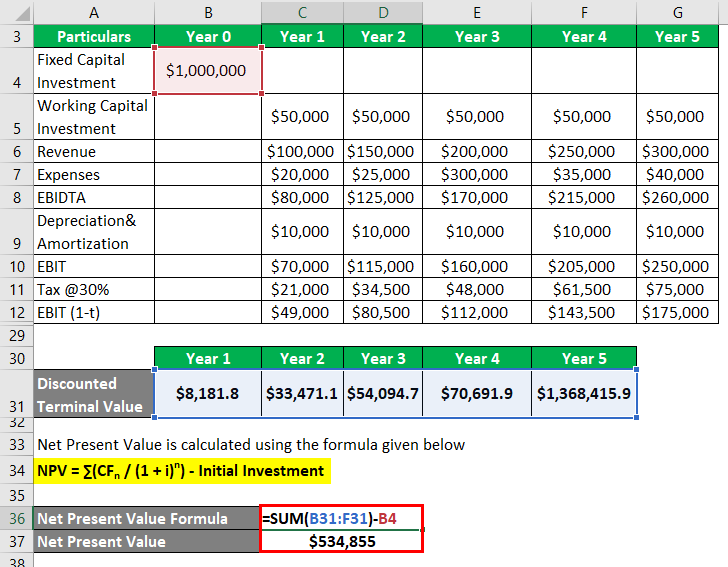

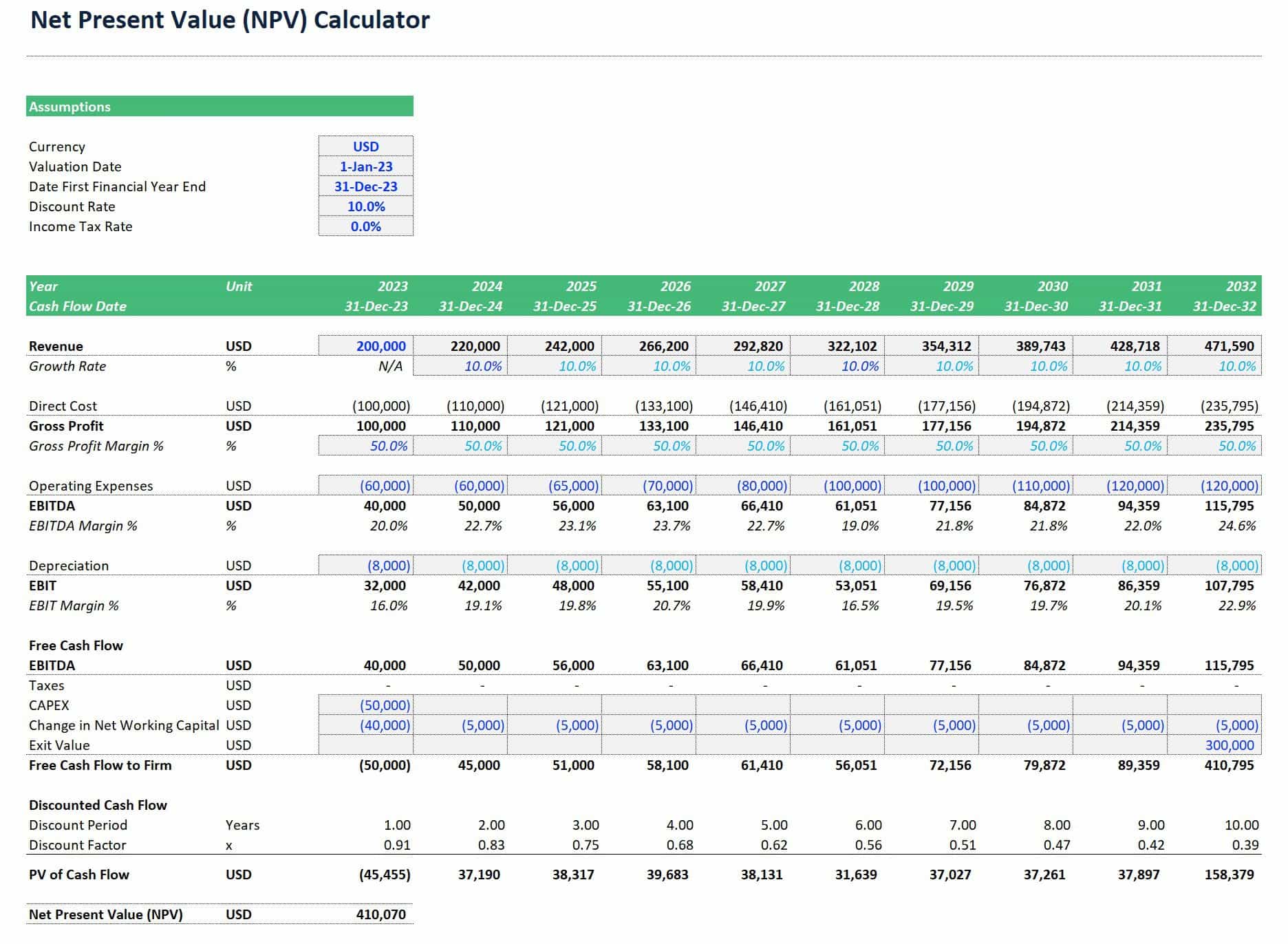

Net Present Value Excel Template

Unlike the npv function in. Net present value (npv) is the present value of all future cash flows of a project. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Net present value is a financial metric used to determine the value of an investment by calculating the difference.

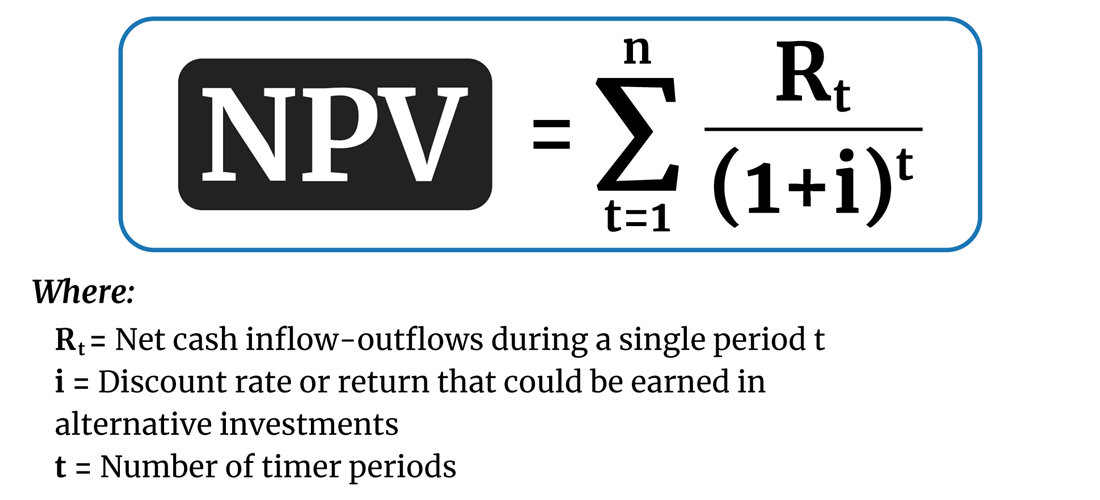

Net Present Value Calculator with Example + Steps

To calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Unlike the npv function in. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the present value of all future cash flows of a project.

Net Present Value Calculator in Excel eFinancialModels

Net present value (npv) is the present value of all future cash flows of a project. Net present value is a financial metric used to determine the value of an investment by calculating the difference. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Unlike the npv function in.

Net Present Value (NPV) What It Means and Steps to Calculate It

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Unlike the npv function in. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Net present value (npv) is the present value of all future cash flows of a project.

Free NPV Calculator Online Calculate Net Present Value AI For Data

Net present value (npv) is the present value of all future cash flows of a project. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Unlike the npv function in.

Net Present Value (NPV) What It Means and Steps to Calculate It

Unlike the npv function in. Net present value (npv) is the present value of all future cash flows of a project. Net present value is a financial metric used to determine the value of an investment by calculating the difference. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel.

Calculate NPV for Monthly Cash Flows with Formula in Excel

Net present value (npv) is the present value of all future cash flows of a project. Unlike the npv function in. Net present value is a financial metric used to determine the value of an investment by calculating the difference. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel.

How to calculate NPV (Non constant cash flows) using a table. YouTube

Net present value is a financial metric used to determine the value of an investment by calculating the difference. To calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Unlike the npv function in. Net present value (npv) is the present value of all future cash flows of a project.

To Calculate The Net Present Value (Npv), Our Recommendation Is To Use The Xnpv Function In Excel.

Net present value (npv) is the present value of all future cash flows of a project. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Unlike the npv function in.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)