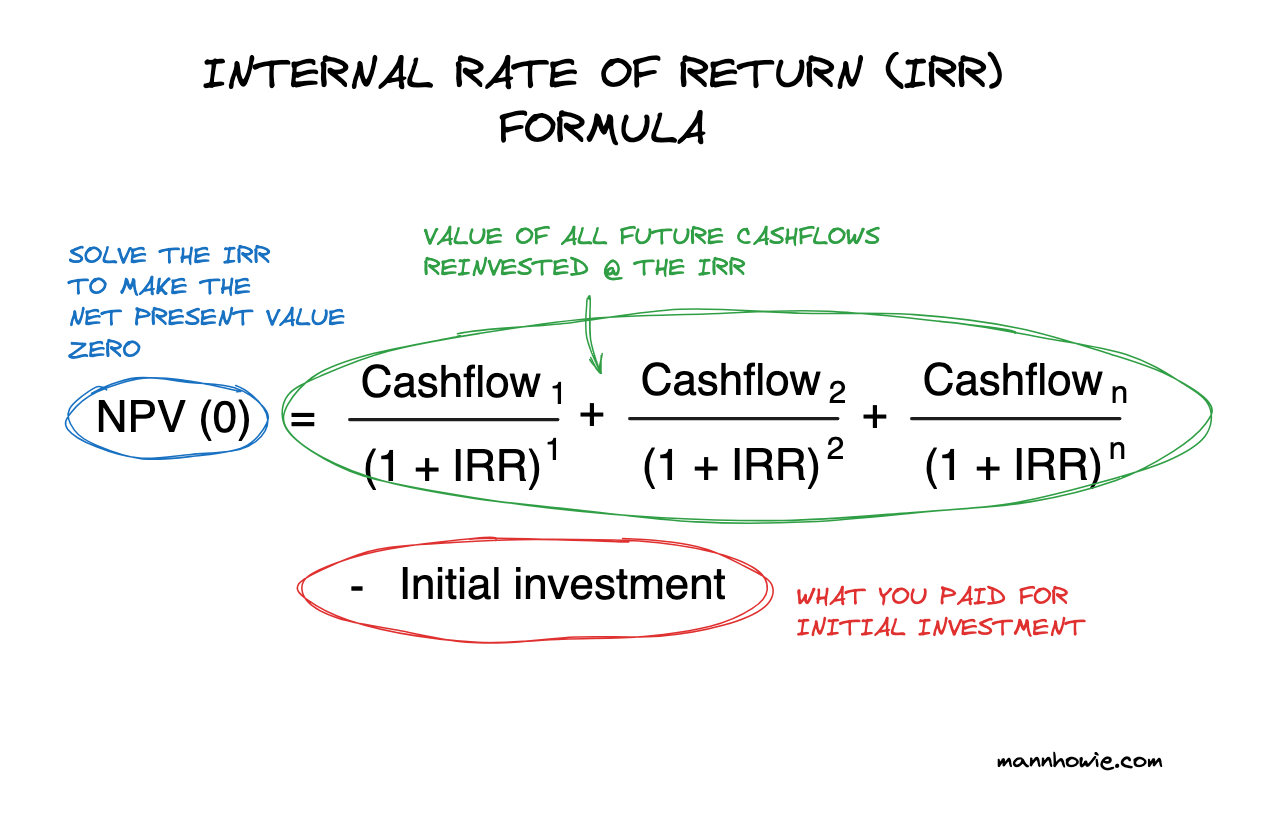

How To Calculate Cash Flows For Irr - Calculating irr is relatively straightforward. Put another way, the initial cash. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. First, you need to determine the cash flows associated with the investment. When calculating irr, expected cash flows for a project or investment are given and the npv equals zero.

Put another way, the initial cash. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. First, you need to determine the cash flows associated with the investment. Calculating irr is relatively straightforward. When calculating irr, expected cash flows for a project or investment are given and the npv equals zero.

Calculating irr is relatively straightforward. First, you need to determine the cash flows associated with the investment. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. Put another way, the initial cash.

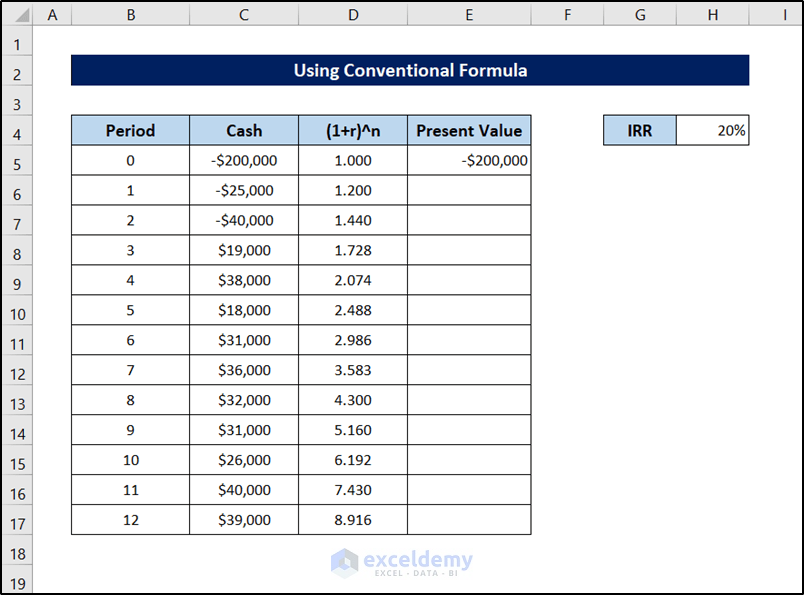

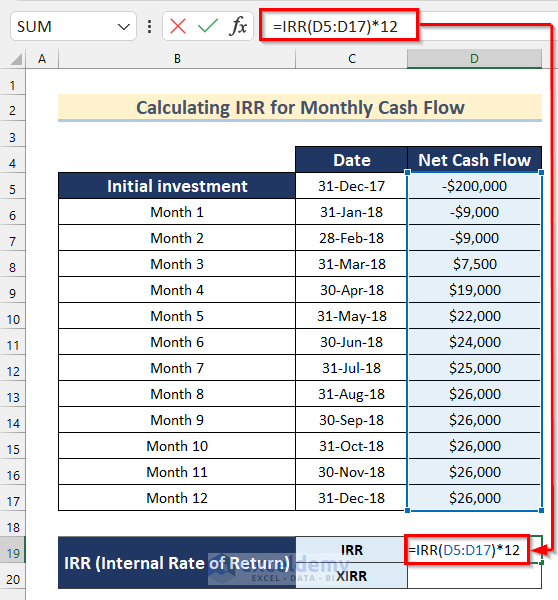

How to Calculate IRR (Internal Rate of Return) in Excel (8 Ways)

Calculating irr is relatively straightforward. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. Put another way, the initial cash. First, you need to determine.

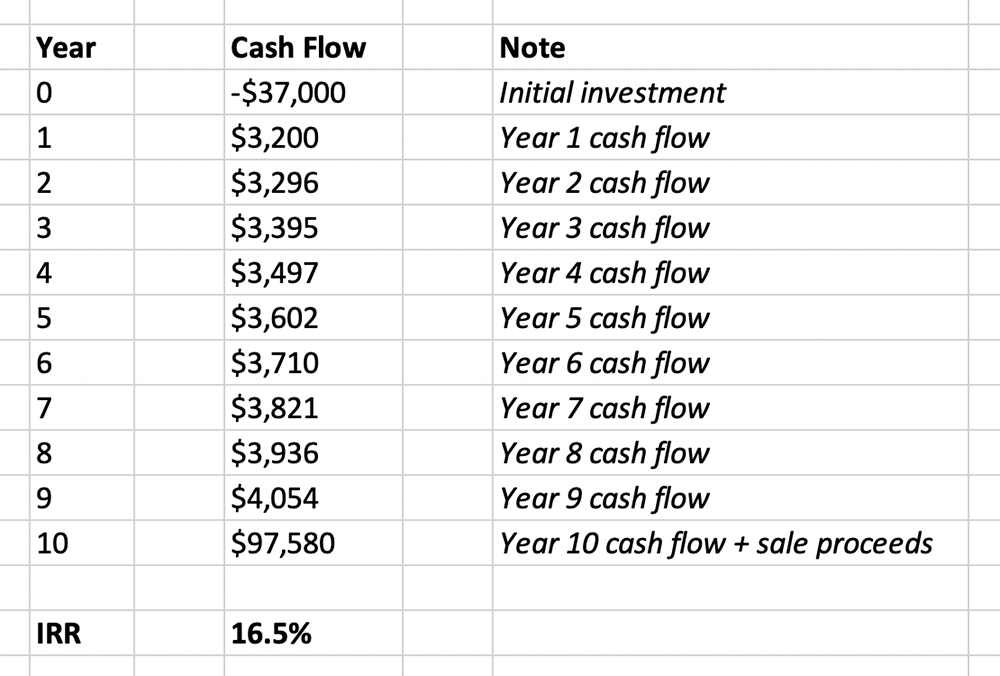

How to Calculate IRR in Excel & Financial Calculator

When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. Put another way, the initial cash. Calculating irr is relatively straightforward. First, you need to determine.

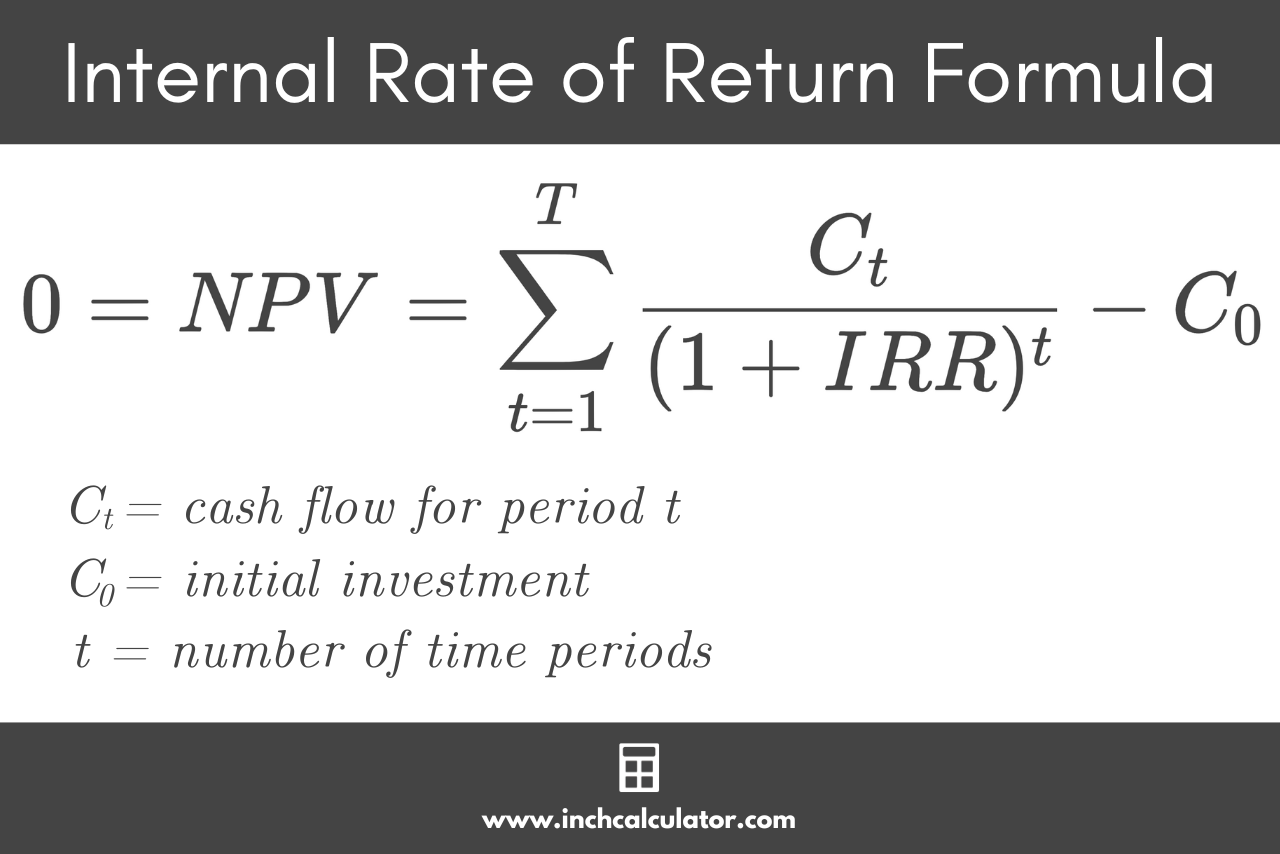

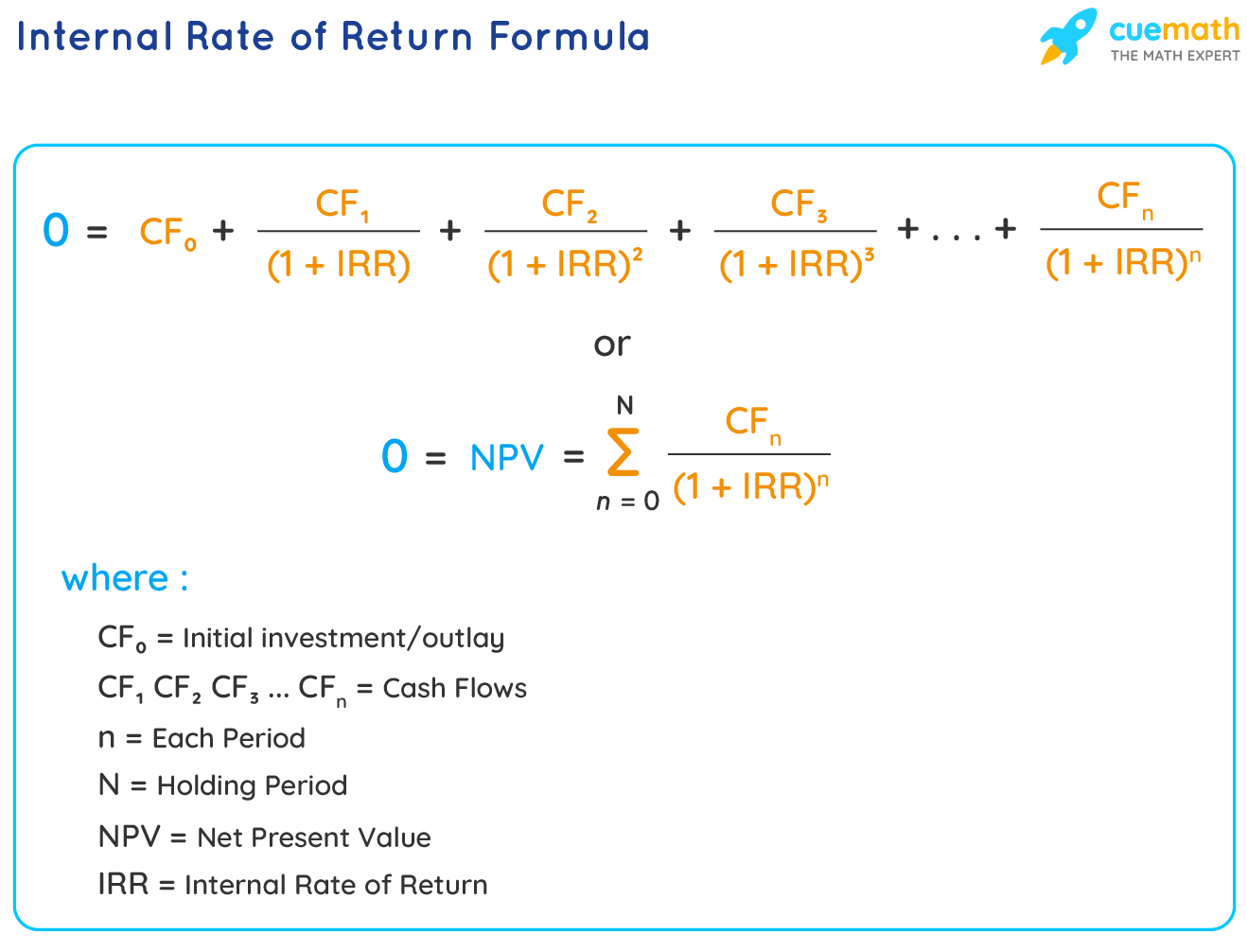

Irr Formula

Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. First, you need to determine the cash flows associated with the investment. Calculating irr is relatively.

How to Calculate IRR in Excel for Monthly Cash Flow 4 Methods

Put another way, the initial cash. First, you need to determine the cash flows associated with the investment. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. When calculating irr, expected cash flows for a project or investment are given and the npv.

How to Calculate the Internal Rate of Return (IRR) for Rental

Calculating irr is relatively straightforward. When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. First, you need to determine the cash flows associated with the.

Calculate Internal Rate Of Return (IRR) For Complex Cash Flows

When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. Put another way, the initial cash. First, you need to determine the cash flows associated with the investment. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv).

Irr Formula

Put another way, the initial cash. Calculating irr is relatively straightforward. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. First, you need to determine.

Internal Rate of Return Formula Derivations, Formula, Examples

Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. First, you need to determine the cash flows associated with the investment. Calculating irr is relatively straightforward. Put another way, the initial cash. When calculating irr, expected cash flows for a project or investment.

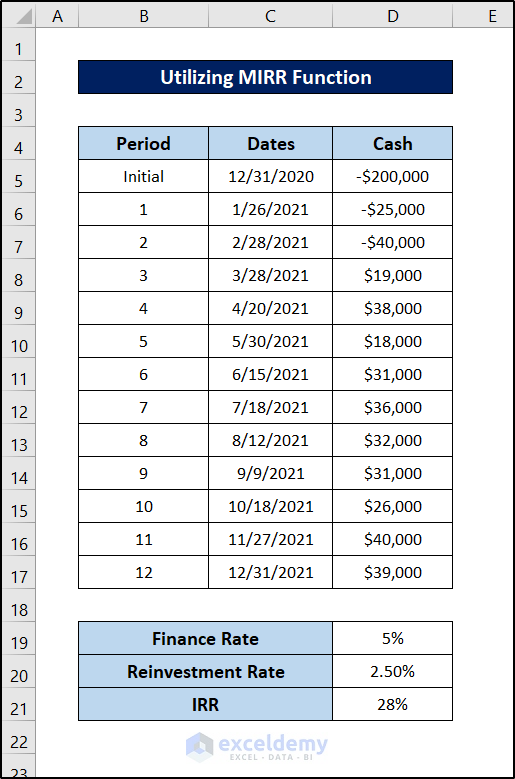

IRR vs MIRR Formula Explained Choose the Right Metric for Your Investments

Calculating irr is relatively straightforward. Put another way, the initial cash. First, you need to determine the cash flows associated with the investment. When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes.

How to Calculate IRR in Excel for Monthly Cash Flow 4 Methods

Calculating irr is relatively straightforward. When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. Put another way, the initial cash. Internal rate of return is a discount rate that is used in project analysis or capital budgeting that makes the net present value (npv) of future. First, you need to determine.

Internal Rate Of Return Is A Discount Rate That Is Used In Project Analysis Or Capital Budgeting That Makes The Net Present Value (Npv) Of Future.

When calculating irr, expected cash flows for a project or investment are given and the npv equals zero. Put another way, the initial cash. Calculating irr is relatively straightforward. First, you need to determine the cash flows associated with the investment.

.jpg)