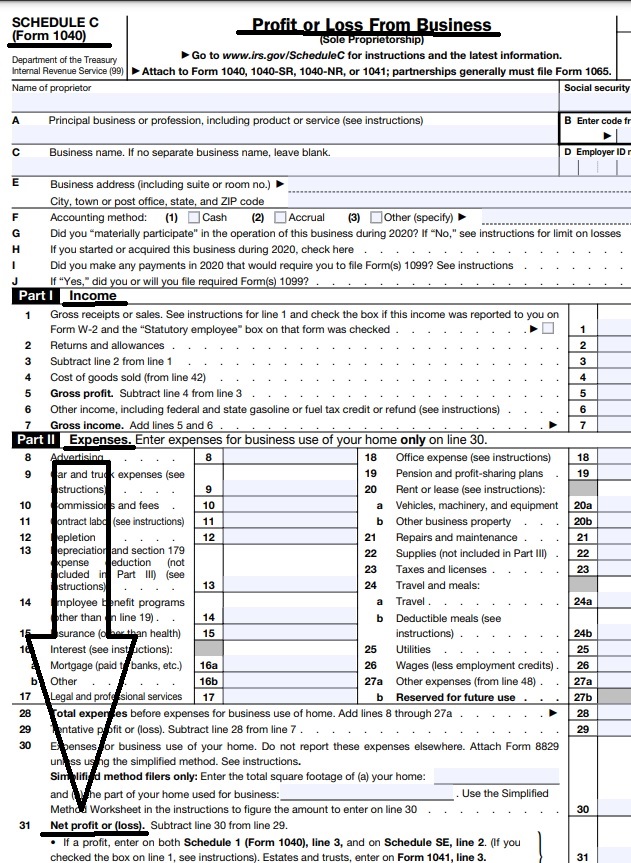

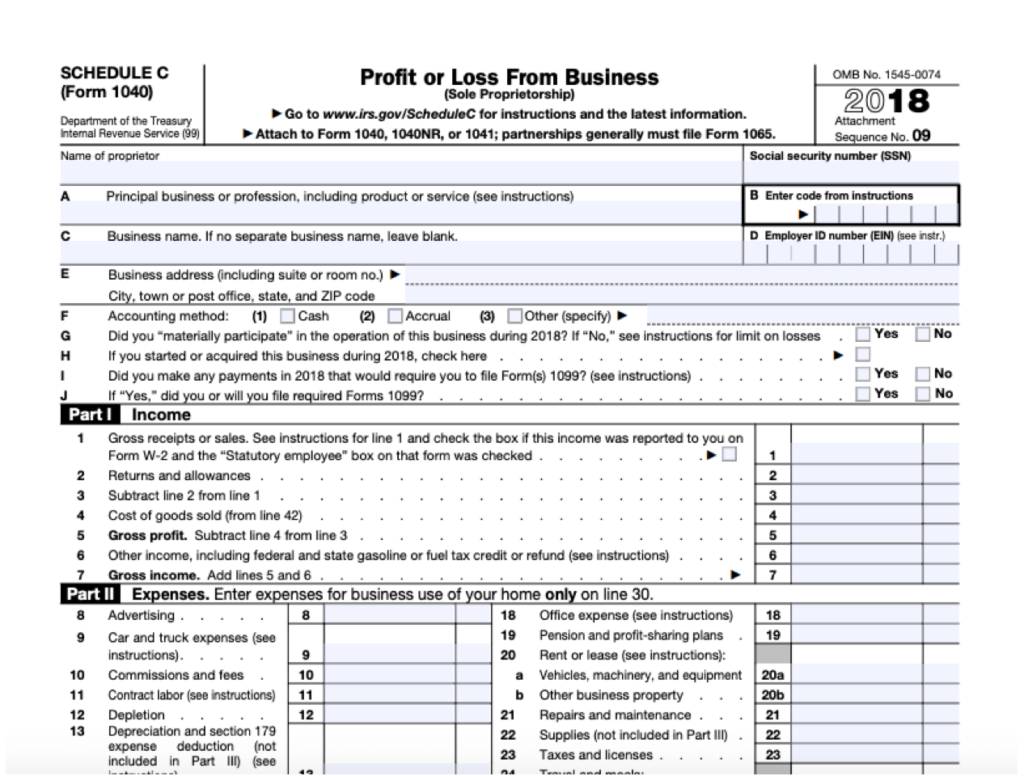

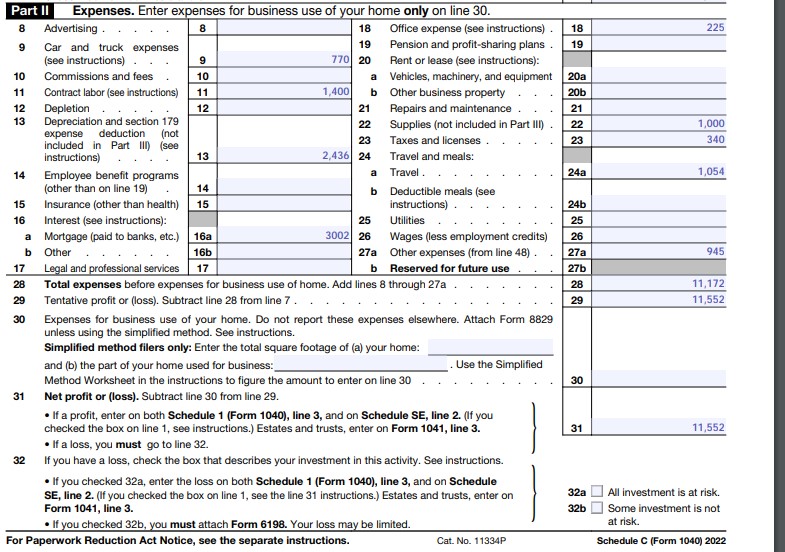

Instructions For 2024 Schedule C - In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. (if you checked the box on. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. What is irs schedule c (form 1040)? Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. What is irs schedule c (form 1040)? (if you checked the box on.

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. What is irs schedule c (form 1040)?

2024 Instructions Schedule C domino's pizza carte

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. (if you checked the box on. Information about schedule c (form 1040), profit.

Schedule C Instructions 2024 Pdf Download Roxy Catarina

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. What is irs schedule c (form 1040)? (if you checked the box.

2024 Instructions For Forms 2024C And 2024C Csc Kitti Lindsay

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. What is irs schedule c (form 1040)? (if you checked the box on..

2024 Schedule C Alia Louise

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule c (form 1040) to report income or (loss) from a business you operated.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

What is irs schedule c (form 1040)? • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

(if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. What is irs schedule c (form 1040)? Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule.

2024 Instructions For Forms 2024C And 2024C C Corp Cathie Doralyn

What is irs schedule c (form 1040)? • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. In.

Instructions For Schedule C 2024 Retha Hyacinthia

In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. (if you checked the box on. What is irs schedule c (form 1040)? Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or.

2024 Form 1040 Schedule C Instructions Meaning Lydia Rochell

(if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. What is irs schedule c (form 1040)? Use schedule.

Schedule C Instructions 2024 Instructions Ivett Letisha

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on. • if you checked 32a, enter the.

In This Article, We’ll Walk You Through Everything You Need To Know About The Schedule C Tax Form, From What It Is To How To.

What is irs schedule c (form 1040)? Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)