Irs Schedule C 2024 Worksheet - Plus irs could ask for odometer readings from oil changes, repair. If you checked none of these above, please continue by completing the worksheet below for each business. Select if this business is for: Cash accrual employer id number other (specify) this business started or was acquired during 2024. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. “evidence” includes mileage logs, appointment records, calendars, etc. (if you checked the box on. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written.

Select if this business is for: If you checked none of these above, please continue by completing the worksheet below for each business. Cash accrual employer id number other (specify) this business started or was acquired during 2024. (if you checked the box on. “evidence” includes mileage logs, appointment records, calendars, etc. Plus irs could ask for odometer readings from oil changes, repair. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written.

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. “evidence” includes mileage logs, appointment records, calendars, etc. Select if this business is for: I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Plus irs could ask for odometer readings from oil changes, repair. If you checked none of these above, please continue by completing the worksheet below for each business. (if you checked the box on. Cash accrual employer id number other (specify) this business started or was acquired during 2024.

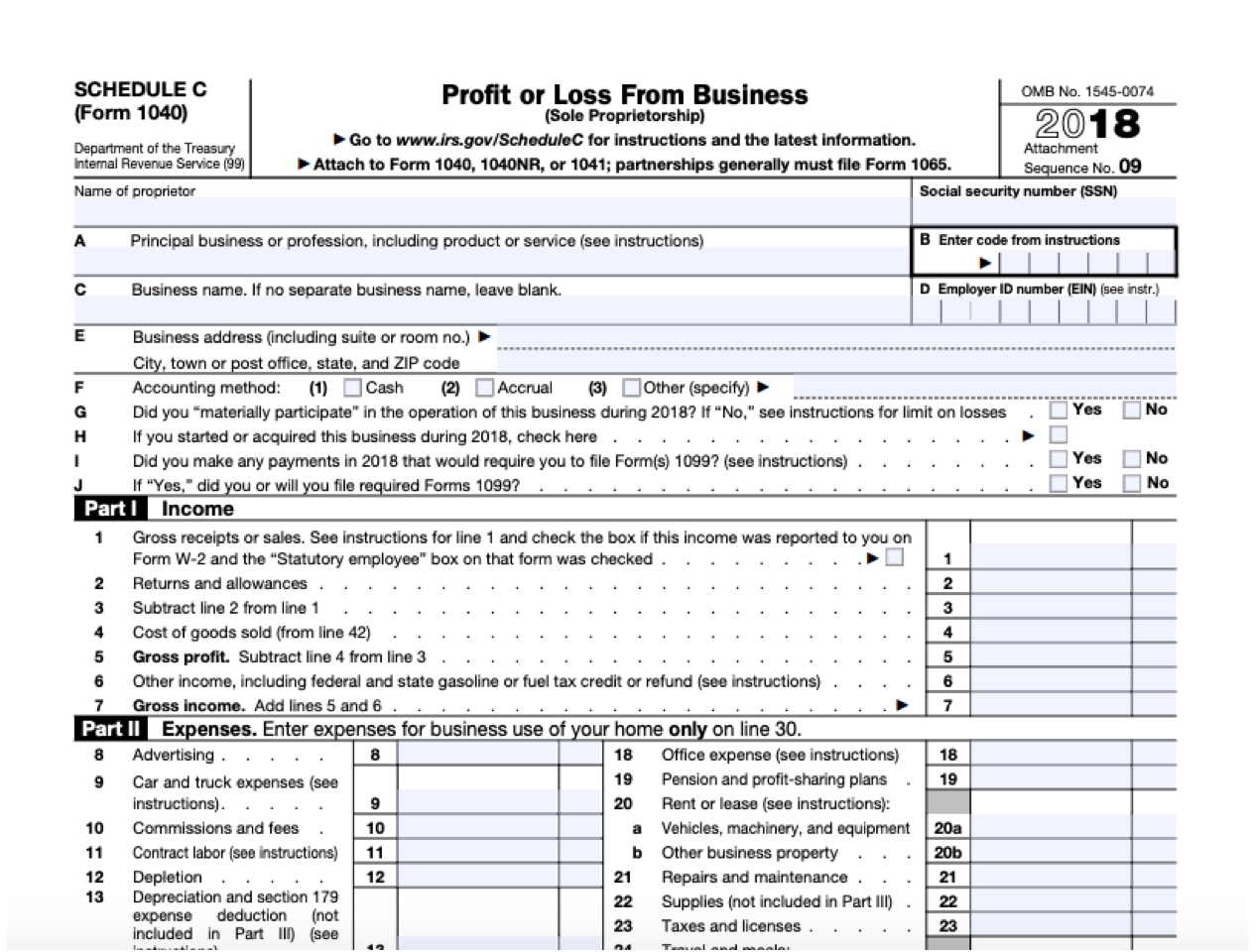

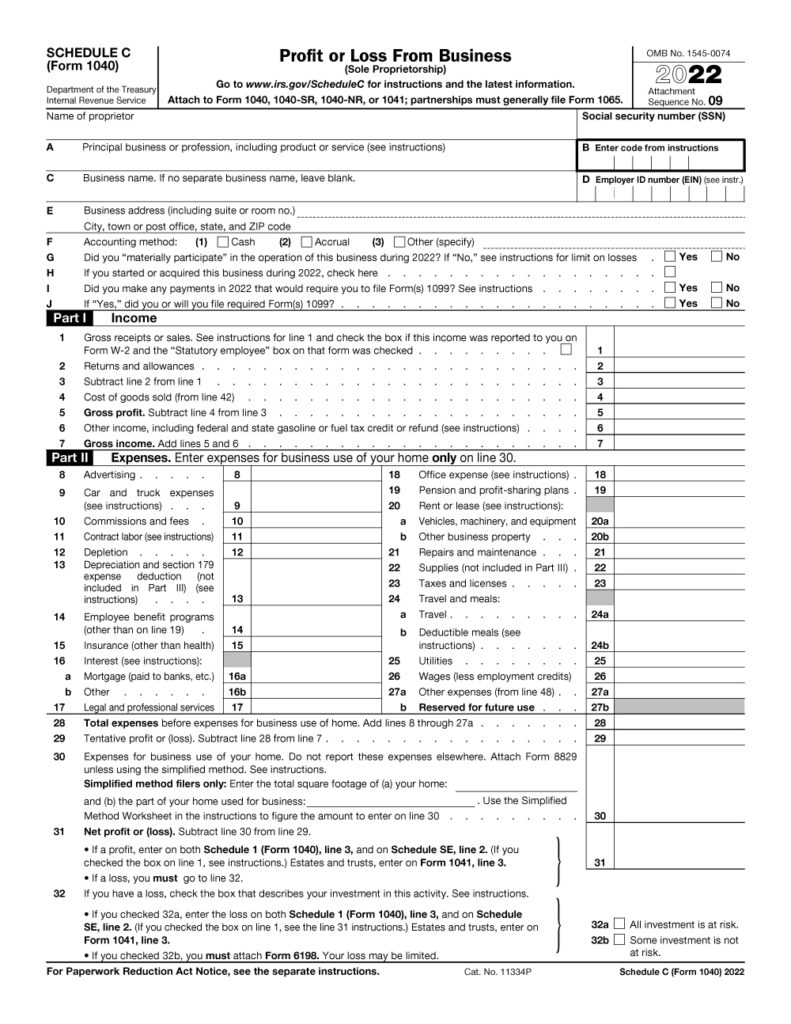

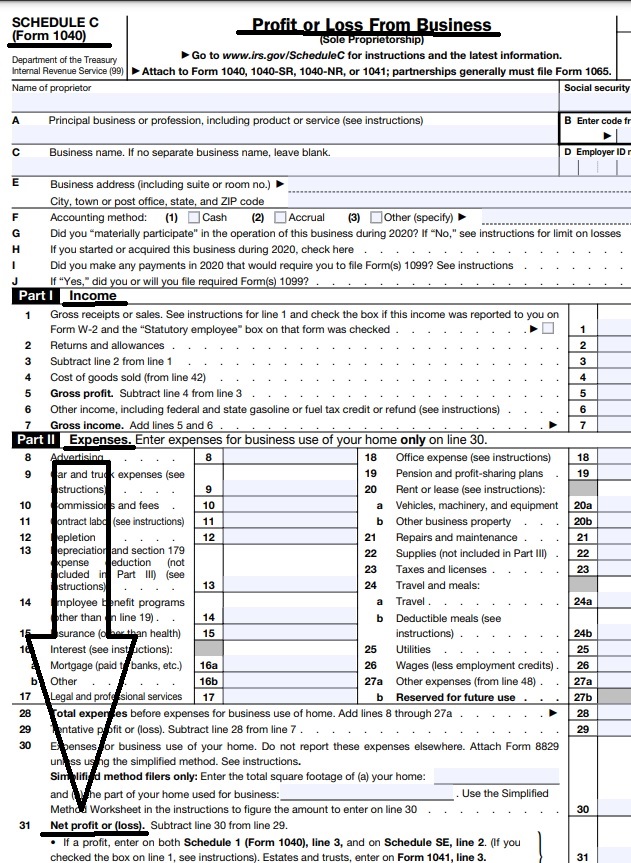

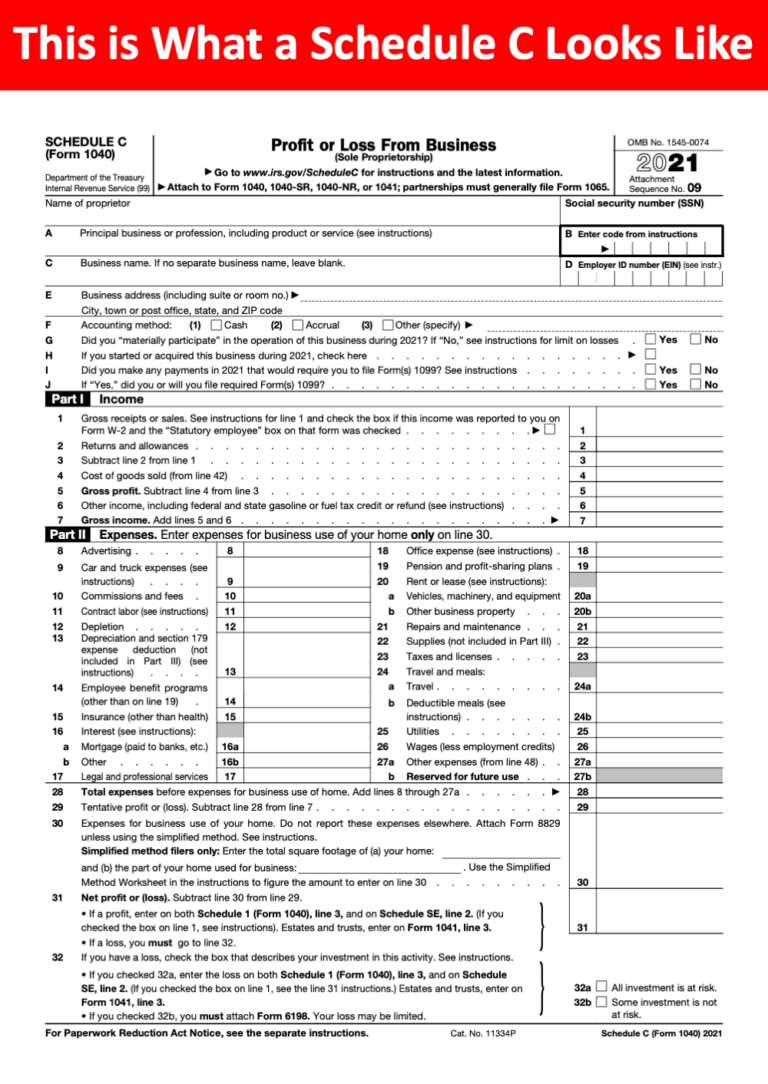

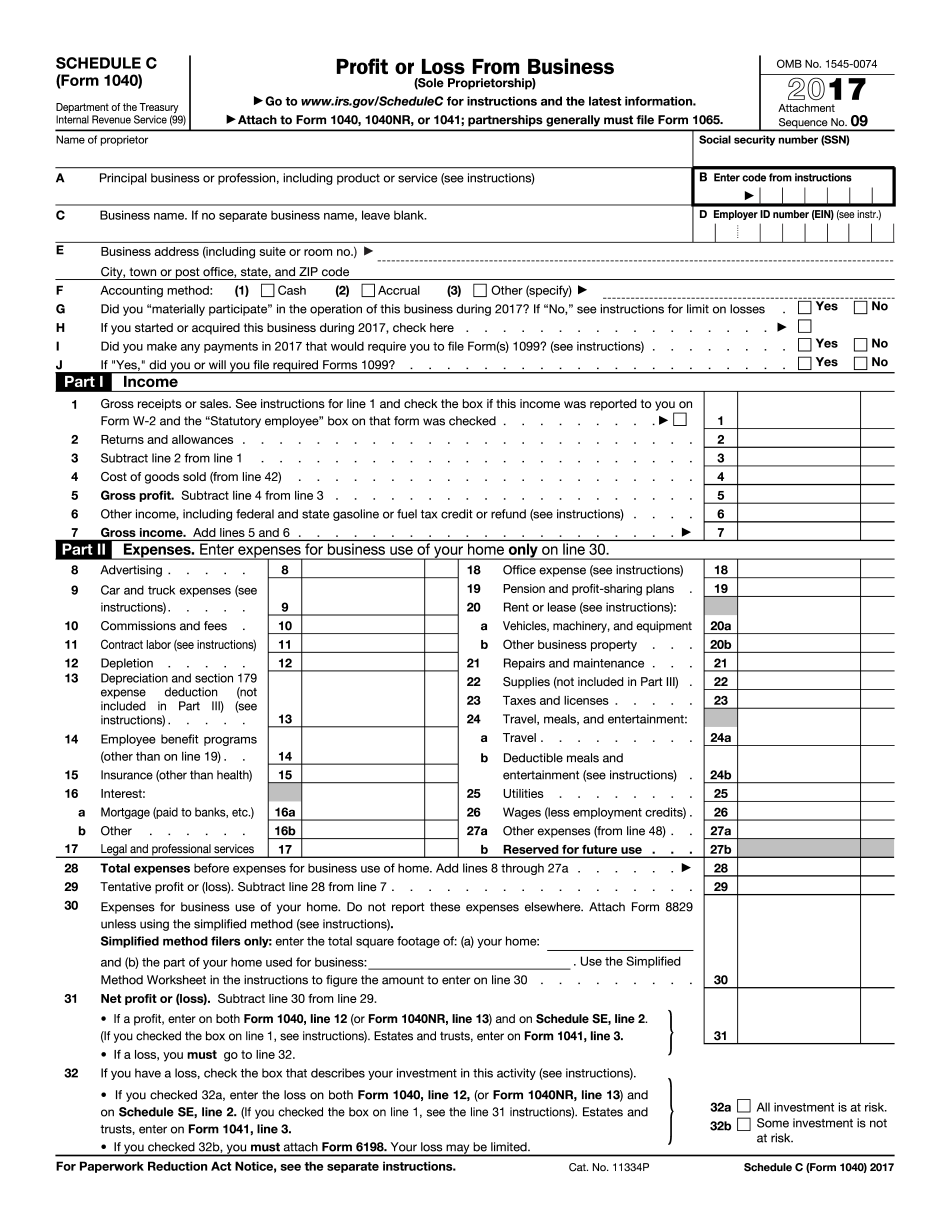

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Cash accrual employer id number other (specify) this business started or was acquired during 2024. Plus irs could ask for odometer readings from oil changes, repair. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3,.

Calculation Worksheet 2024

If you checked none of these above, please continue by completing the worksheet below for each business. Plus irs could ask for odometer readings from oil changes, repair. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Cash accrual employer id number other (specify) this business started or was acquired during.

Schedule C 2024 Herta Giralda

If you checked none of these above, please continue by completing the worksheet below for each business. Cash accrual employer id number other (specify) this business started or was acquired during 2024. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Select if this business is for:.

2024 Schedule C Form 1040 Worksheet Alida Barbara

Select if this business is for: Plus irs could ask for odometer readings from oil changes, repair. If you checked none of these above, please continue by completing the worksheet below for each business. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Cash accrual employer id.

Schedule C Form 1040 Insturctions 2024 2024 Schedule A

(if you checked the box on. Cash accrual employer id number other (specify) this business started or was acquired during 2024. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you checked none of these above, please continue by completing the worksheet below for each business. “evidence” includes mileage logs,.

2024 Schedule C Form Maren Florentia

(if you checked the box on. “evidence” includes mileage logs, appointment records, calendars, etc. If you checked none of these above, please continue by completing the worksheet below for each business. Select if this business is for: • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

Irs Schedule C 2024 Tove Ainslie

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. If you checked none of these above, please continue by completing the worksheet below for each business. (if you checked the box on. I hereby verify that the income and expense information set forth on this worksheet is.

Schedule C Printable Form

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Cash accrual employer id number other (specify) this business started or was acquired during 2024. (if you checked the box on. “evidence” includes mileage logs, appointment records, calendars, etc. Select if this business is for:

Irs Fillable Forms 2024 Schedule C Penny Blondell

“evidence” includes mileage logs, appointment records, calendars, etc. (if you checked the box on. Select if this business is for: If you checked none of these above, please continue by completing the worksheet below for each business. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. If you checked none of these above, please continue by completing the worksheet below for each business. (if you checked.

Select If This Business Is For:

Plus irs could ask for odometer readings from oil changes, repair. “evidence” includes mileage logs, appointment records, calendars, etc. If you checked none of these above, please continue by completing the worksheet below for each business. Cash accrual employer id number other (specify) this business started or was acquired during 2024.

• If You Checked 32A, Enter The Loss On Both Schedule 1 (Form 1040), Line 3, And On Schedule Se, Line 2.

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. (if you checked the box on.