Irs Schedule C Worksheet 2023 - I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Plus irs could ask for odometer readings from oil changes, repair. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you checked any of the above, we are unable to prepare your return per the irs. If you checked none of these above, please continue by. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. “evidence” includes mileage logs, appointment records, calendars, etc.

“evidence” includes mileage logs, appointment records, calendars, etc. If you checked any of the above, we are unable to prepare your return per the irs. If you checked none of these above, please continue by. Plus irs could ask for odometer readings from oil changes, repair. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,.

If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. If you checked none of these above, please continue by. If you checked any of the above, we are unable to prepare your return per the irs. Plus irs could ask for odometer readings from oil changes, repair. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. “evidence” includes mileage logs, appointment records, calendars, etc.

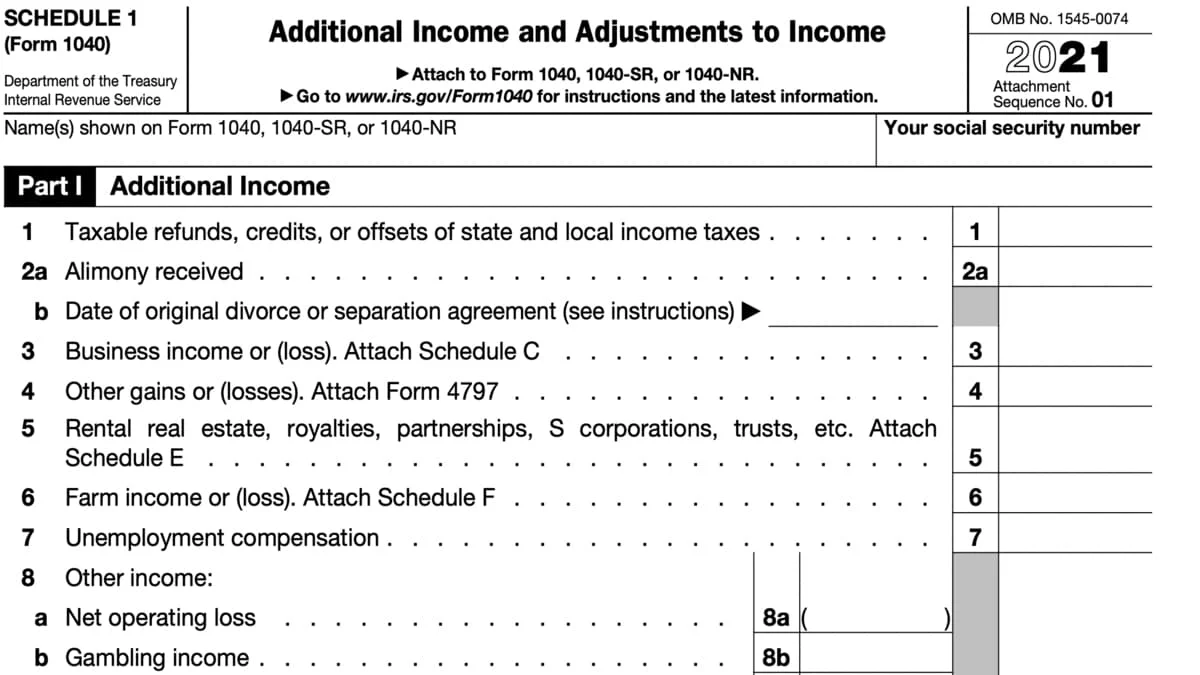

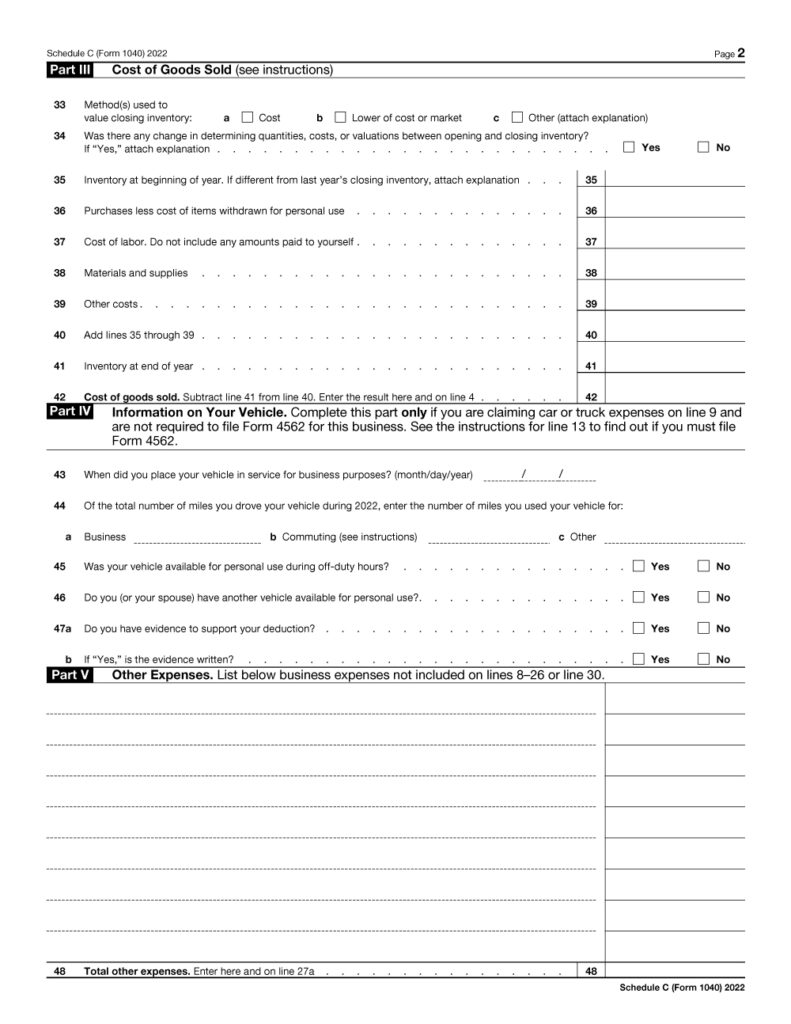

Printable Schedule C 2023

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Plus irs could ask for odometer readings from oil changes, repair. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. If you checked any of the above, we are.

Printable Schedule C 2023

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Plus irs could ask for odometer readings from oil changes, repair. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you purchased any business assets (furniture, equipment, vehicles,.

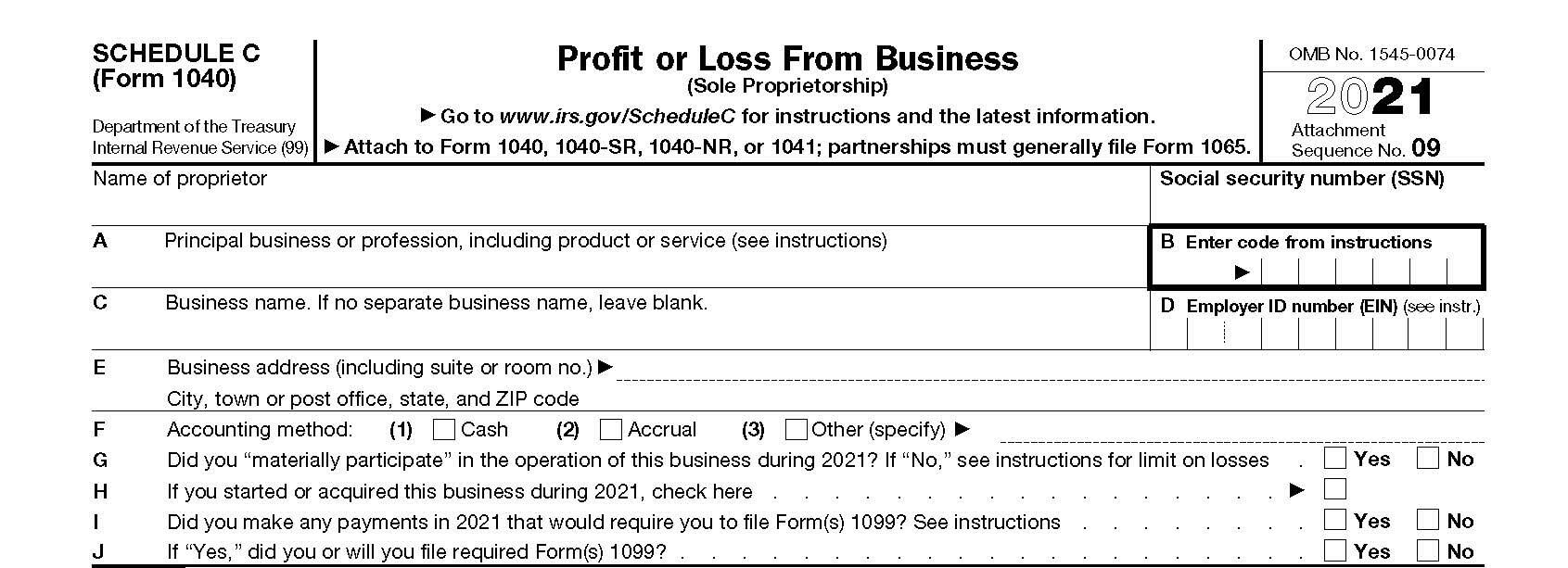

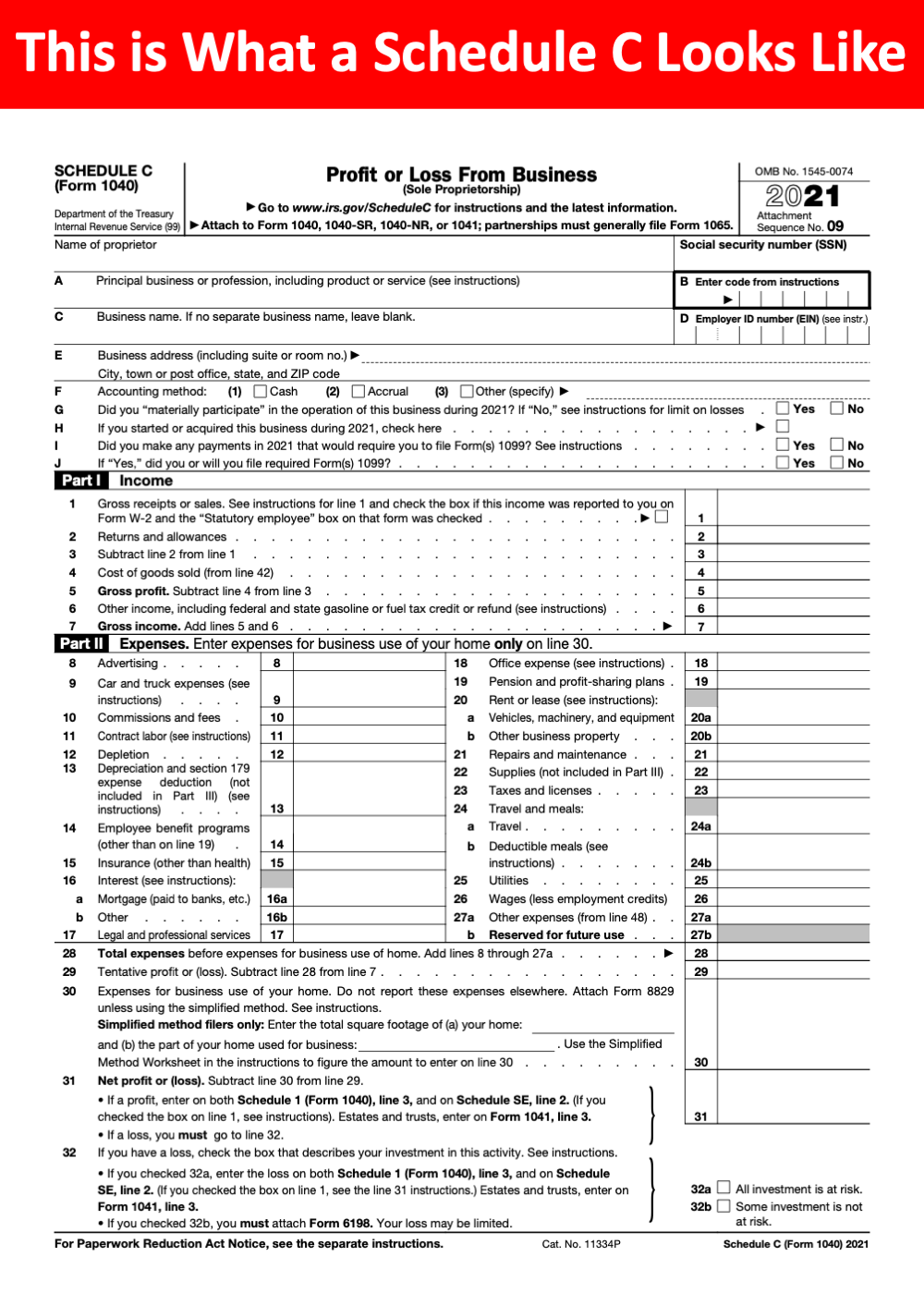

How to Complete IRS Schedule C

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Plus irs could ask for odometer readings from oil changes, repair. If you checked any of the above, we are unable to prepare your return per the irs. “evidence” includes mileage logs, appointment records, calendars, etc. If you.

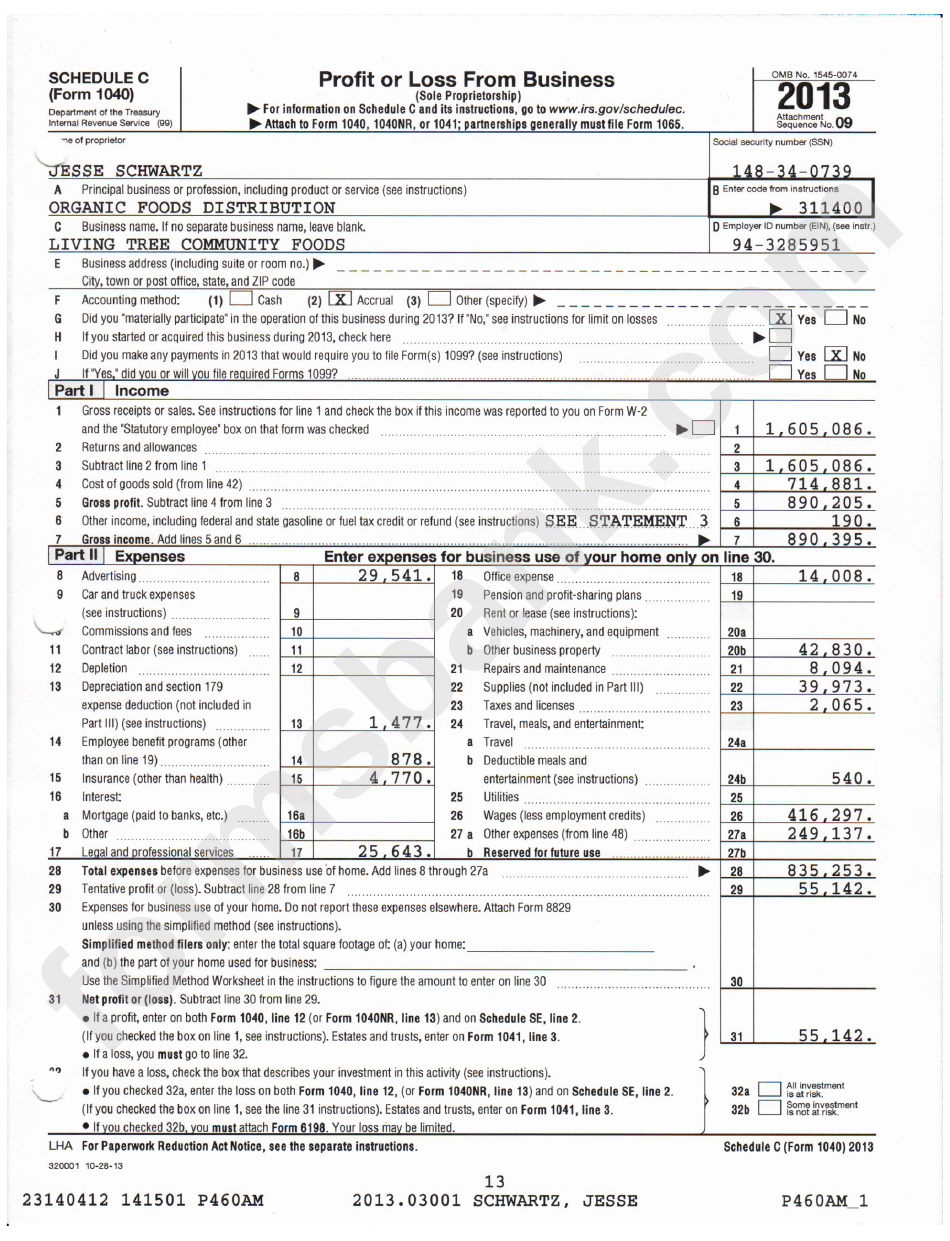

Form 1040 Schedule C Sample Profit Or Loss From Busin vrogue.co

If you checked none of these above, please continue by. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. If you checked any of the above, we are unable.

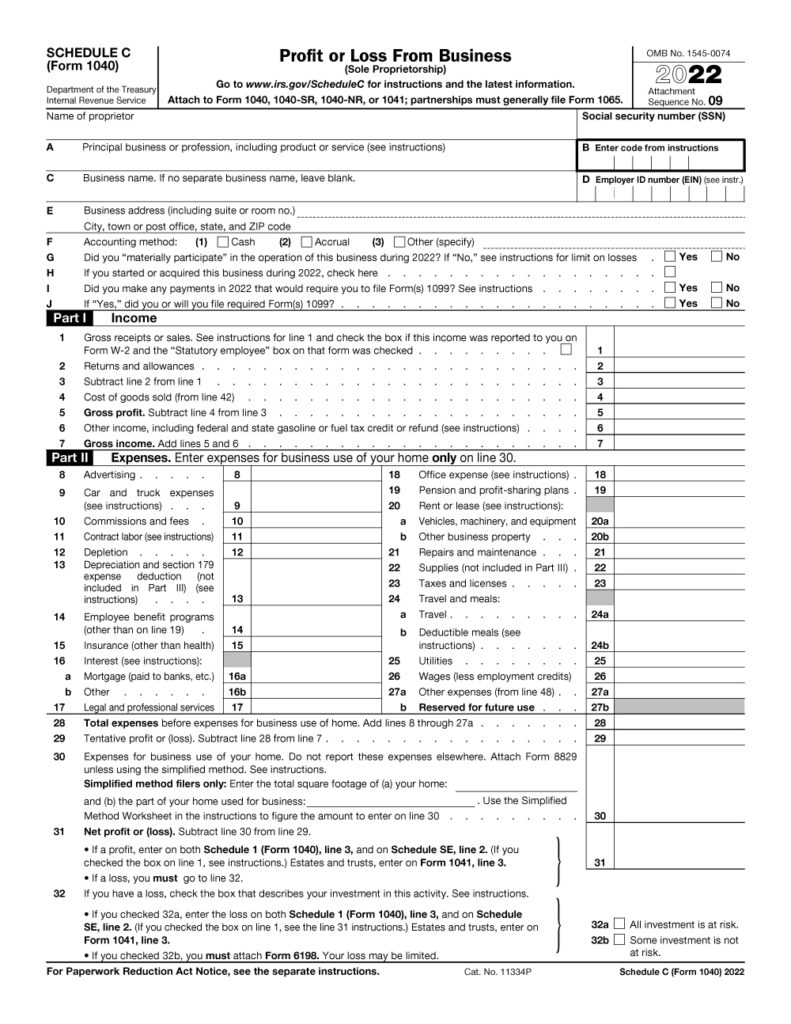

Schedule C (Form 1040) 2023 Instructions

If you checked none of these above, please continue by. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you checked any of the above, we are unable to prepare your return per the irs. I hereby verify that the income and expense information set forth.

Schedule C 2023 Form Printable Forms Free Online

Plus irs could ask for odometer readings from oil changes, repair. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you checked any of the above, we are unable to prepare your return per the irs. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted.

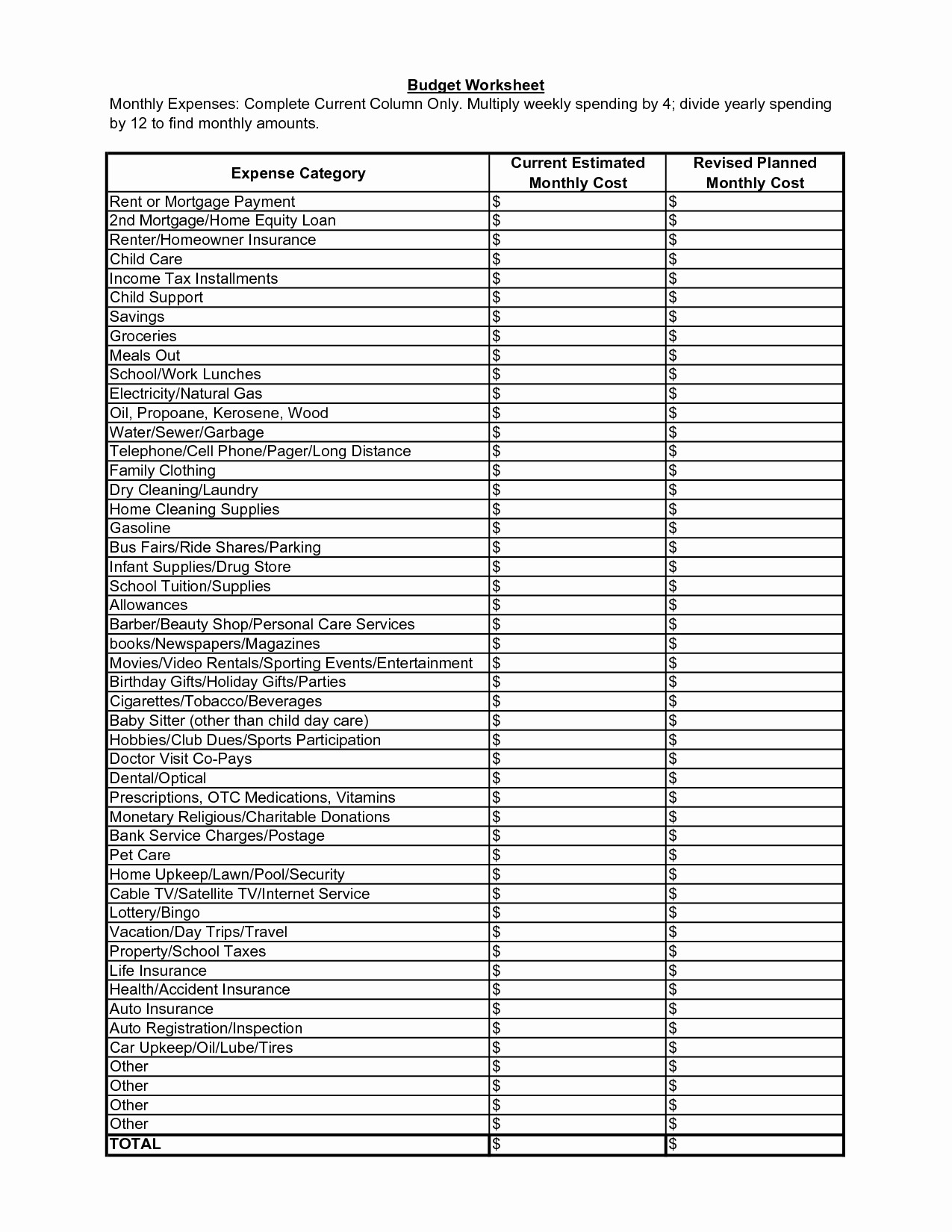

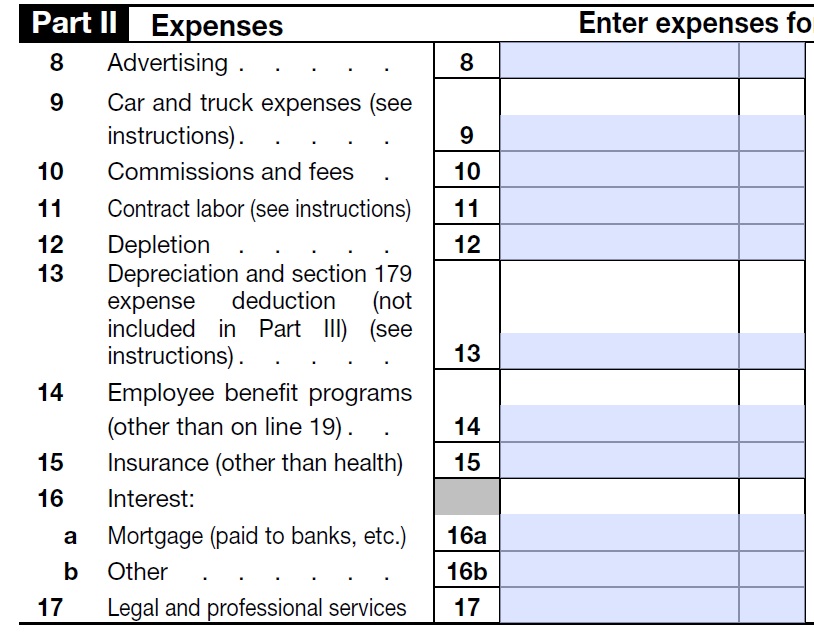

Schedule C Expenses Worksheet 2023

Plus irs could ask for odometer readings from oil changes, repair. “evidence” includes mileage logs, appointment records, calendars, etc. If you checked none of these above, please continue by. If you checked any of the above, we are unable to prepare your return per the irs. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted.

Schedule C (Form 1040) 2023 Instructions

Plus irs could ask for odometer readings from oil changes, repair. If you checked any of the above, we are unable to prepare your return per the irs. “evidence” includes mileage logs, appointment records, calendars, etc. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. If claimed,.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you checked any of the above, we are unable to prepare your return per the irs. If you checked none of these above, please continue by. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any.

Printable Schedule C 2023

If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you checked none of these above, please continue by. I hereby verify that the income.

If You Purchased Any Business Assets (Furniture, Equipment, Vehicles, Real Estate, Etc.) Or Converted Any Personal Assets To Business Use In 2023,.

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you checked any of the above, we are unable to prepare your return per the irs. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you checked none of these above, please continue by.

“Evidence” Includes Mileage Logs, Appointment Records, Calendars, Etc.

Plus irs could ask for odometer readings from oil changes, repair.