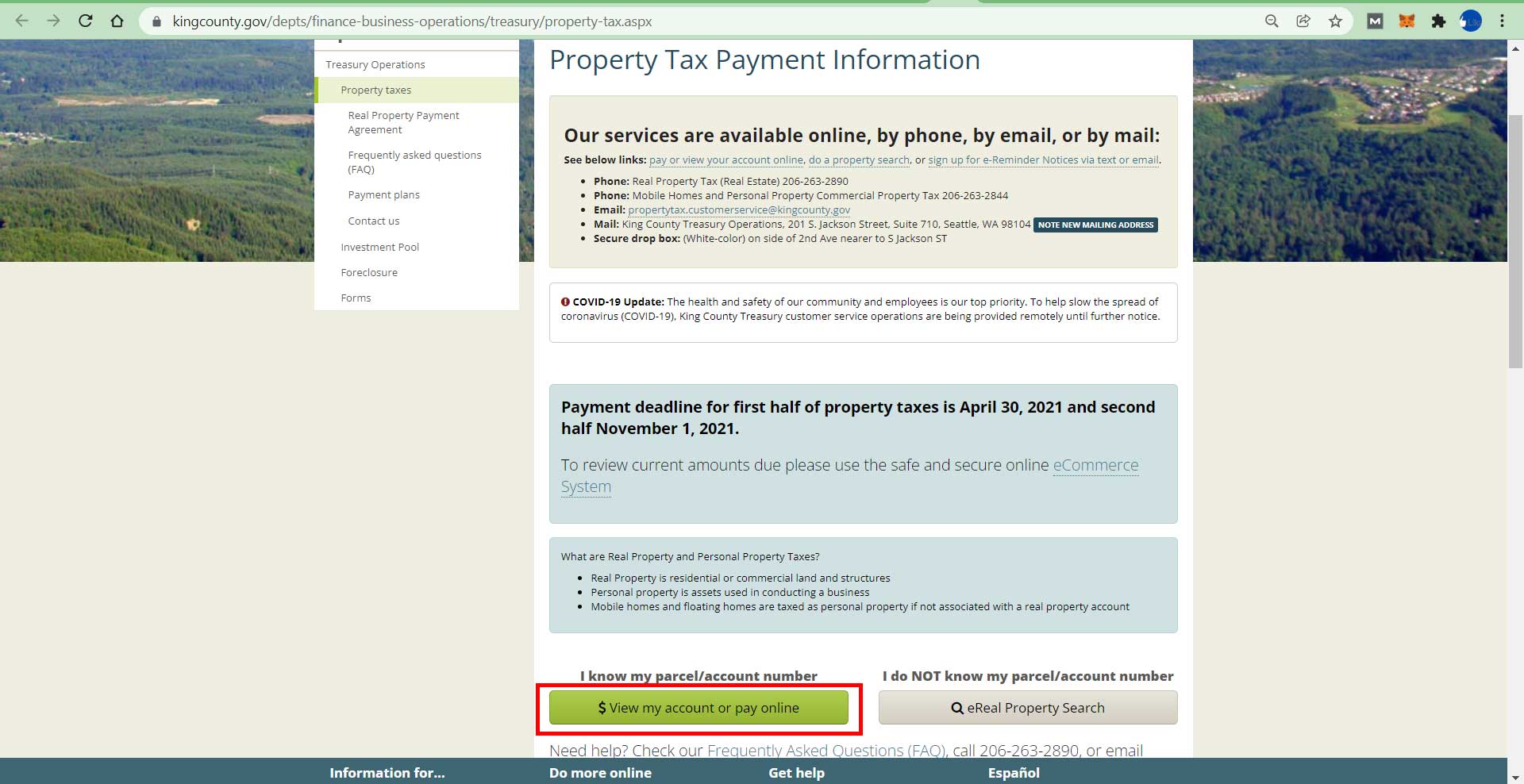

King County Property Tax Payment Options - How, when, and where to pay king county property taxes. To help taxpayers impacted by economic hardship, king county has a property tax payment plan program available for real property homes,. Use ereal property search to look up your. Pay any bills for king county invoices other than capacity charge or property tax. To make the payment process easier, king county provides several ways for property owners to pay their taxes quickly and conveniently. The property tax payment deadline for first half taxes is may 1, 2023. How to find your tax account or parcel number. Select the payment you would like to make: Check your tax statement or property value notice.

Select the payment you would like to make: How, when, and where to pay king county property taxes. To make the payment process easier, king county provides several ways for property owners to pay their taxes quickly and conveniently. Check your tax statement or property value notice. Use ereal property search to look up your. To help taxpayers impacted by economic hardship, king county has a property tax payment plan program available for real property homes,. Pay any bills for king county invoices other than capacity charge or property tax. How to find your tax account or parcel number. The property tax payment deadline for first half taxes is may 1, 2023.

Pay any bills for king county invoices other than capacity charge or property tax. How, when, and where to pay king county property taxes. Use ereal property search to look up your. Check your tax statement or property value notice. Select the payment you would like to make: To make the payment process easier, king county provides several ways for property owners to pay their taxes quickly and conveniently. The property tax payment deadline for first half taxes is may 1, 2023. How to find your tax account or parcel number. To help taxpayers impacted by economic hardship, king county has a property tax payment plan program available for real property homes,.

Property Tax King 2025

Pay any bills for king county invoices other than capacity charge or property tax. How, when, and where to pay king county property taxes. Use ereal property search to look up your. To help taxpayers impacted by economic hardship, king county has a property tax payment plan program available for real property homes,. The property tax payment deadline for first.

Property Tax King 2025

How to find your tax account or parcel number. How, when, and where to pay king county property taxes. Select the payment you would like to make: Use ereal property search to look up your. Check your tax statement or property value notice.

Property Tax King 2025

To make the payment process easier, king county provides several ways for property owners to pay their taxes quickly and conveniently. How to find your tax account or parcel number. Use ereal property search to look up your. Check your tax statement or property value notice. To help taxpayers impacted by economic hardship, king county has a property tax payment.

Property Tax King 2025

Pay any bills for king county invoices other than capacity charge or property tax. How to find your tax account or parcel number. Select the payment you would like to make: Check your tax statement or property value notice. How, when, and where to pay king county property taxes.

Property Tax King 2025

How, when, and where to pay king county property taxes. Check your tax statement or property value notice. To help taxpayers impacted by economic hardship, king county has a property tax payment plan program available for real property homes,. To make the payment process easier, king county provides several ways for property owners to pay their taxes quickly and conveniently..

Property Tax King 2025

Check your tax statement or property value notice. Pay any bills for king county invoices other than capacity charge or property tax. To help taxpayers impacted by economic hardship, king county has a property tax payment plan program available for real property homes,. Select the payment you would like to make: The property tax payment deadline for first half taxes.

Property Tax King 2025

Use ereal property search to look up your. To help taxpayers impacted by economic hardship, king county has a property tax payment plan program available for real property homes,. To make the payment process easier, king county provides several ways for property owners to pay their taxes quickly and conveniently. The property tax payment deadline for first half taxes is.

Property Tax King 2025

How, when, and where to pay king county property taxes. To make the payment process easier, king county provides several ways for property owners to pay their taxes quickly and conveniently. Pay any bills for king county invoices other than capacity charge or property tax. Select the payment you would like to make: To help taxpayers impacted by economic hardship,.

Property Tax King 2025

The property tax payment deadline for first half taxes is may 1, 2023. To help taxpayers impacted by economic hardship, king county has a property tax payment plan program available for real property homes,. Check your tax statement or property value notice. Use ereal property search to look up your. To make the payment process easier, king county provides several.

How To Find Your Tax Account Or Parcel Number.

Pay any bills for king county invoices other than capacity charge or property tax. Check your tax statement or property value notice. How, when, and where to pay king county property taxes. To make the payment process easier, king county provides several ways for property owners to pay their taxes quickly and conveniently.

Select The Payment You Would Like To Make:

The property tax payment deadline for first half taxes is may 1, 2023. To help taxpayers impacted by economic hardship, king county has a property tax payment plan program available for real property homes,. Use ereal property search to look up your.