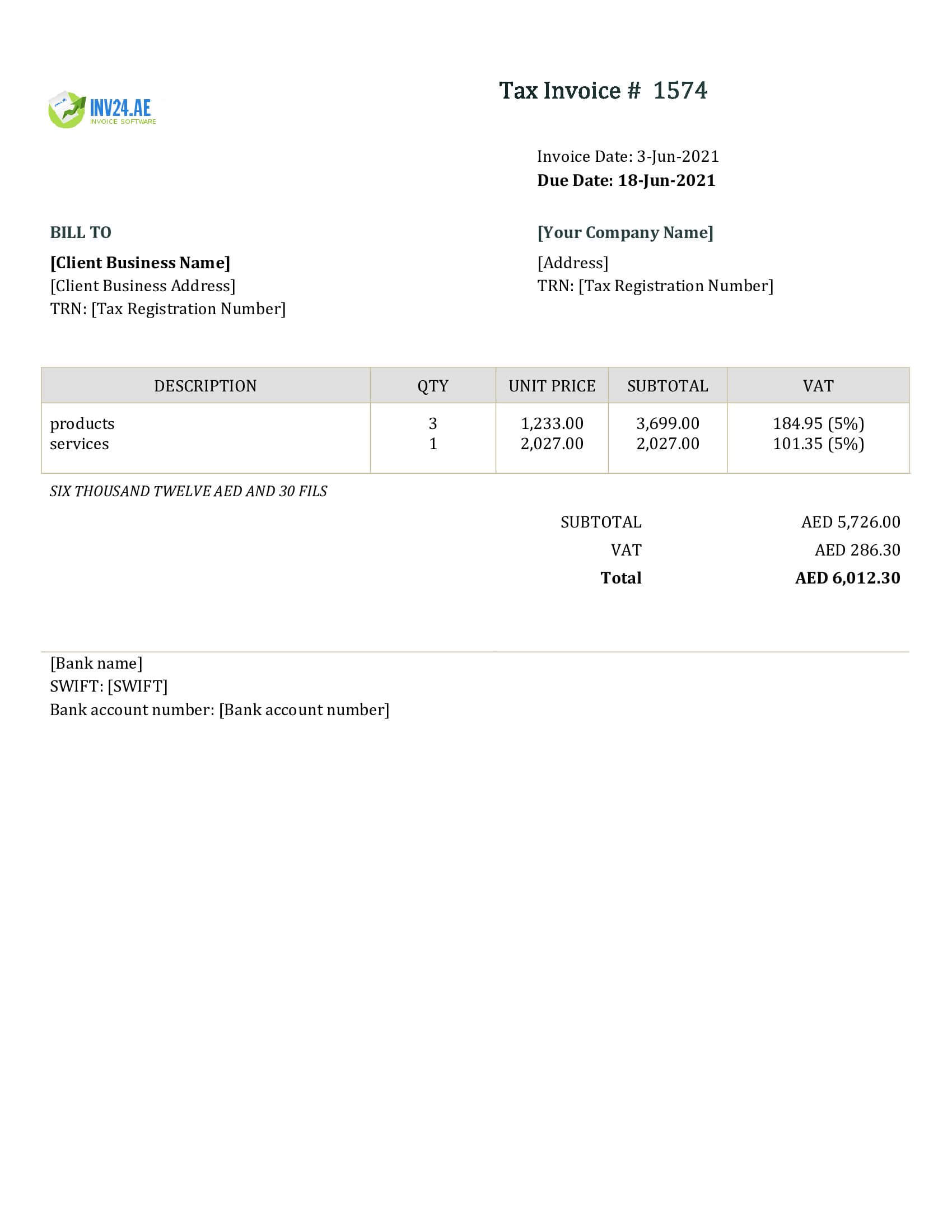

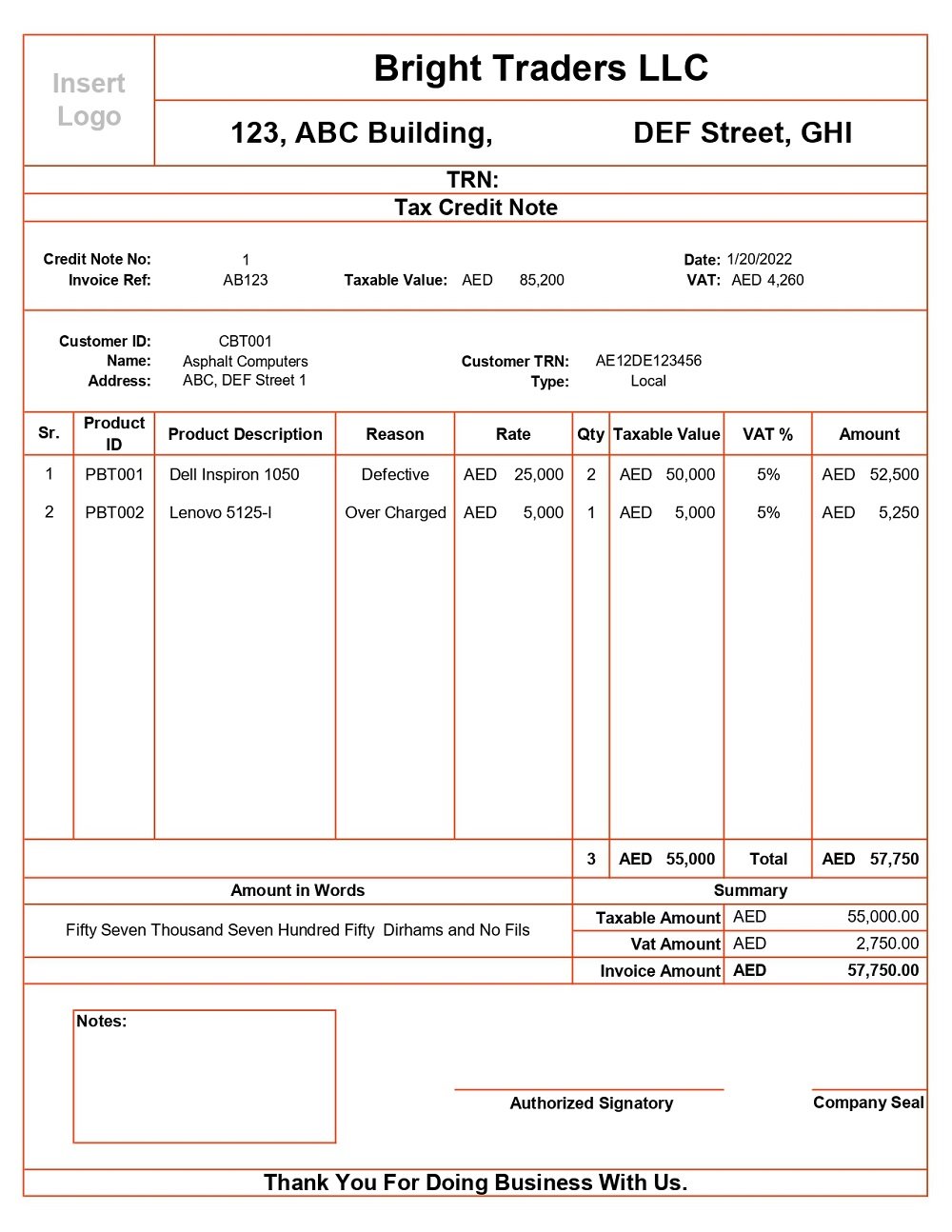

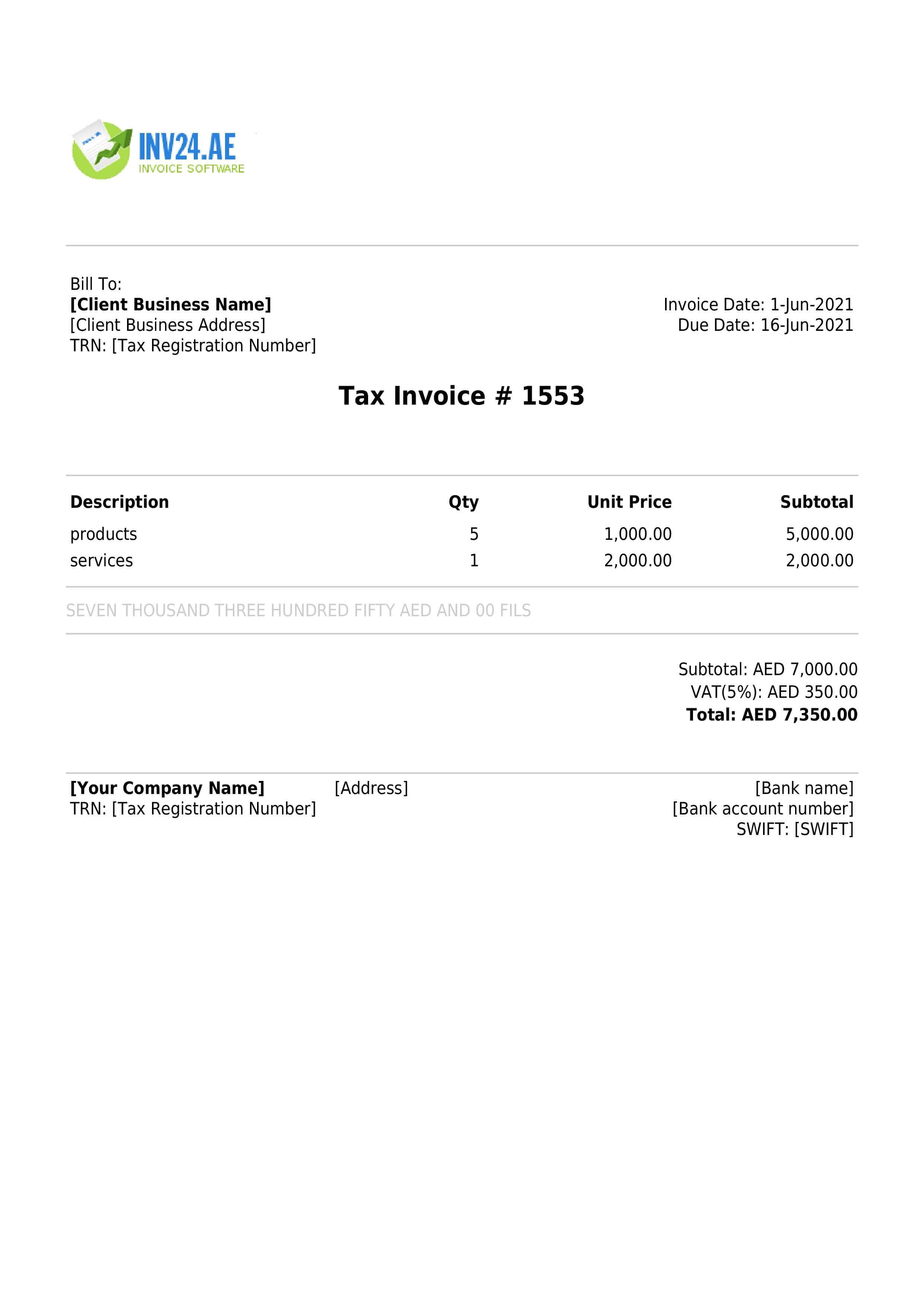

Prepaid Tax Invoice Uae - (8) of 2017 on value added tax. Article 59 of cabinet decision no. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. The tax invoice must be issued and delivered to. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat.

Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. The tax invoice must be issued and delivered to. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. (8) of 2017 on value added tax. Article 59 of cabinet decision no.

Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. (8) of 2017 on value added tax. Article 59 of cabinet decision no. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. The tax invoice must be issued and delivered to.

3 Top Invoicing Tools (Free & Paid) for UAE

Article 59 of cabinet decision no. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. The tax invoice must be issued and delivered to. (8) of 2017 on value added tax. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips.

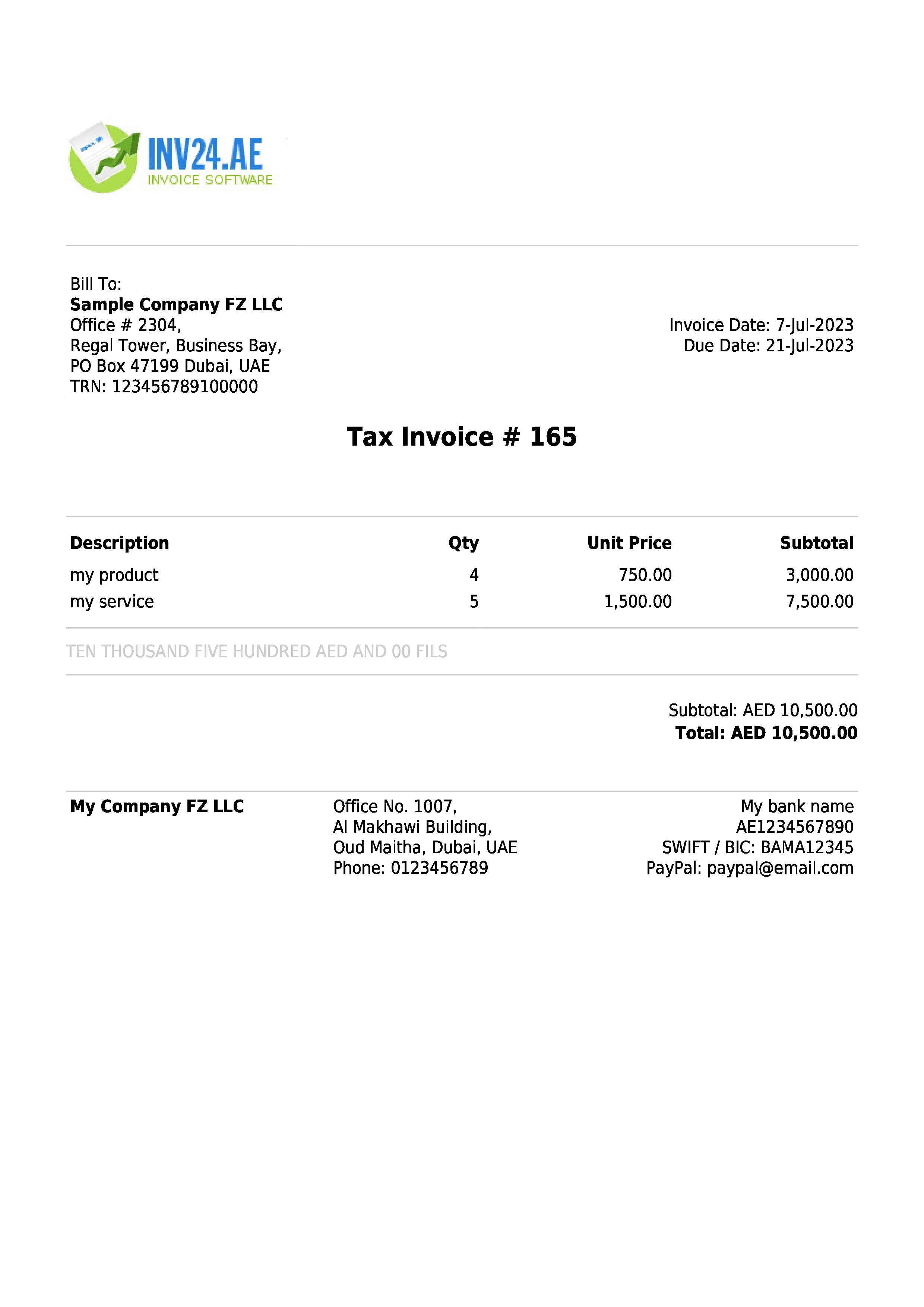

Invoice for VAT nonpayer in UAE Definition, Sample and Creation

Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat..

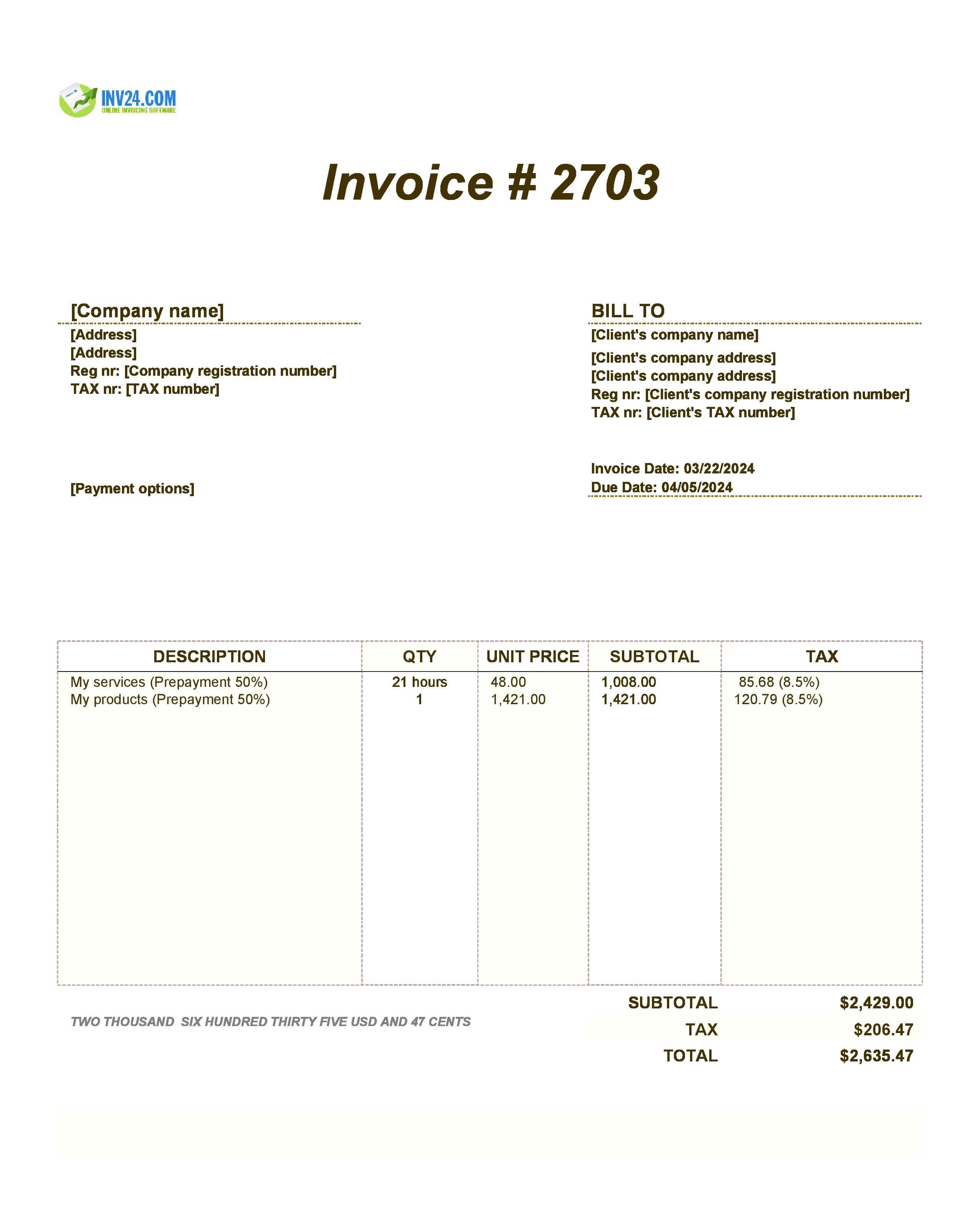

Prepayment Invoice Meaning & Example

(8) of 2017 on value added tax. Article 59 of cabinet decision no. The tax invoice must be issued and delivered to. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of.

Download Uae Invoice Template With Vat In Excel Arabi vrogue.co

The tax invoice must be issued and delivered to. (8) of 2017 on value added tax. Article 59 of cabinet decision no. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization.

Invoices in UAE All You Need to Know

Article 59 of cabinet decision no. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. (8) of 2017 on value added tax. The tax invoice must be issued and delivered to. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of.

Overview Lago

The tax invoice must be issued and delivered to. Article 59 of cabinet decision no. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Learn how to create compliant vat.

Invoices Overview Maxio

Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. (8) of 2017 on value added tax. The tax invoice must be issued and delivered to. Issuing a tax invoice.

What Is a Prepayment Invoice and How Do I Create One? Blinksale

The tax invoice must be issued and delivered to. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. (8) of 2017 on value added tax. Article 59 of cabinet decision no. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and.

How to print dates and item prices in Arabic numerals in NetSuite

Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Article 59 of cabinet decision no. Businesses and government entities are set to benefit from a new approach to.

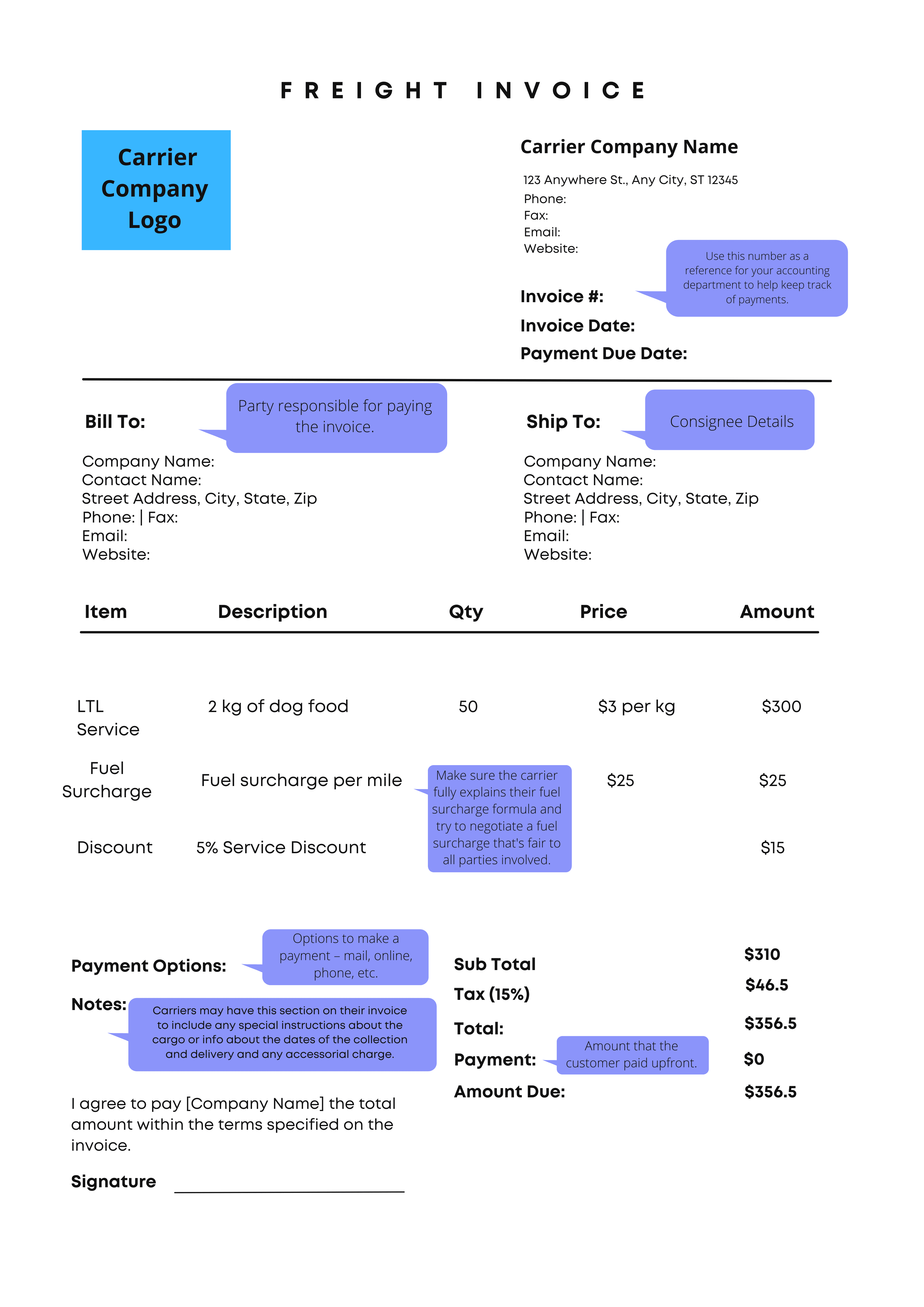

Abf Freight Invoice at Robyn blog

Article 59 of cabinet decision no. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. (8) of 2017 on value added tax. Issuing a tax invoice in the uae.

Article 59 Of Cabinet Decision No.

The tax invoice must be issued and delivered to. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. (8) of 2017 on value added tax. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using.