Reverse Discounted Cash Flow Calculator - The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Instead of projecting future cash flows to. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Calculate the implied growth rate needed to. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in.

The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. Calculate the implied growth rate needed to. Instead of projecting future cash flows to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps.

In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Instead of projecting future cash flows to. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. Calculate the implied growth rate needed to.

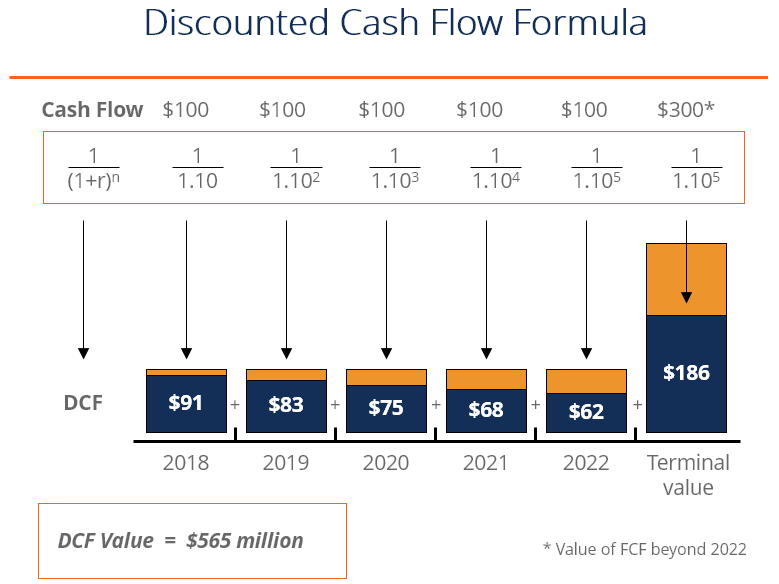

What Is Reverse Discounted Cash Flow (DCF) and how to calculate it?

Instead of projecting future cash flows to. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Free discounted cash flow (dcf), reverse.

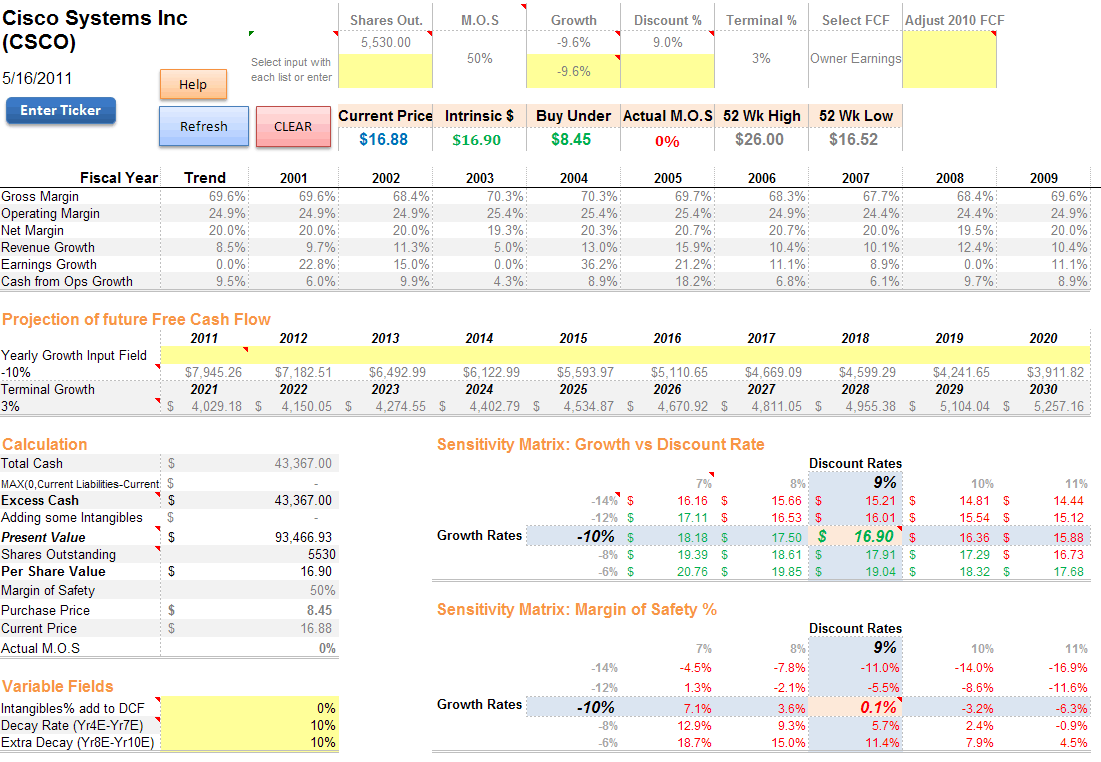

How to Value a Stock With Reverse Discounted Cash Flow Seeking Alpha

Calculate the implied growth rate needed to. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. Free reverse discounted cash flow (dcf).

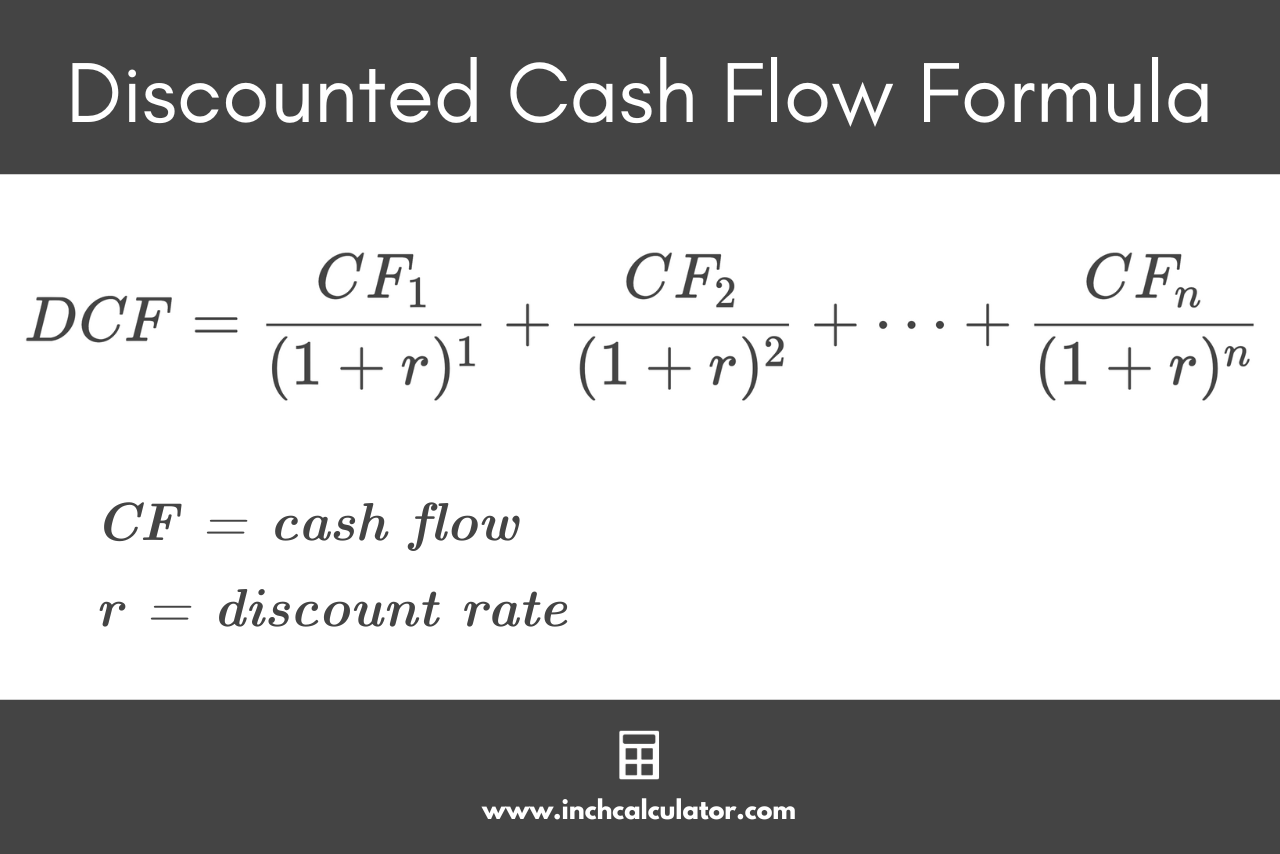

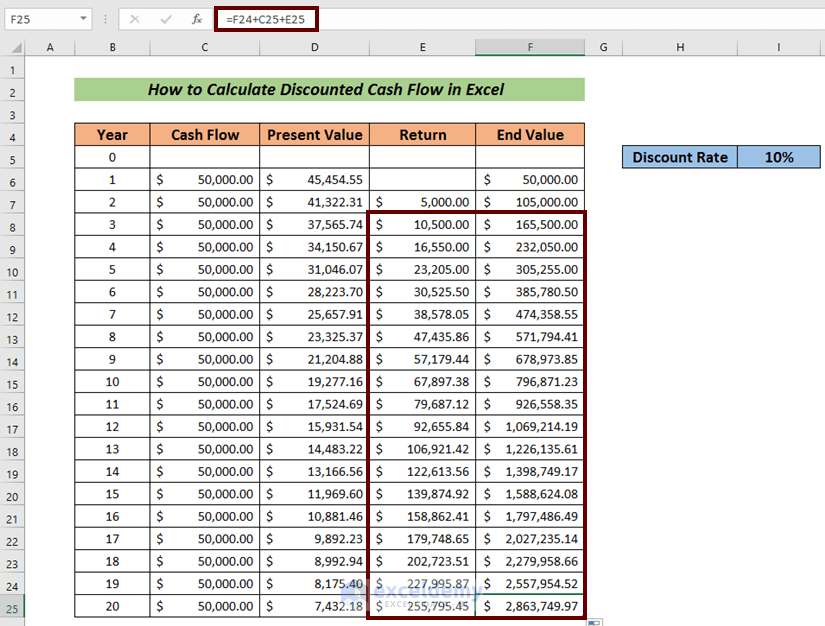

Discounted Cash Flow Calculator Inch Calculator

The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Calculate the implied growth rate needed to. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and.

How to Apply the Reverse Discounted Cash Flow Valuation Model StableBread

In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Instead of projecting future cash flows to. Free reverse dcf calculator (reverse discounted cash flow.

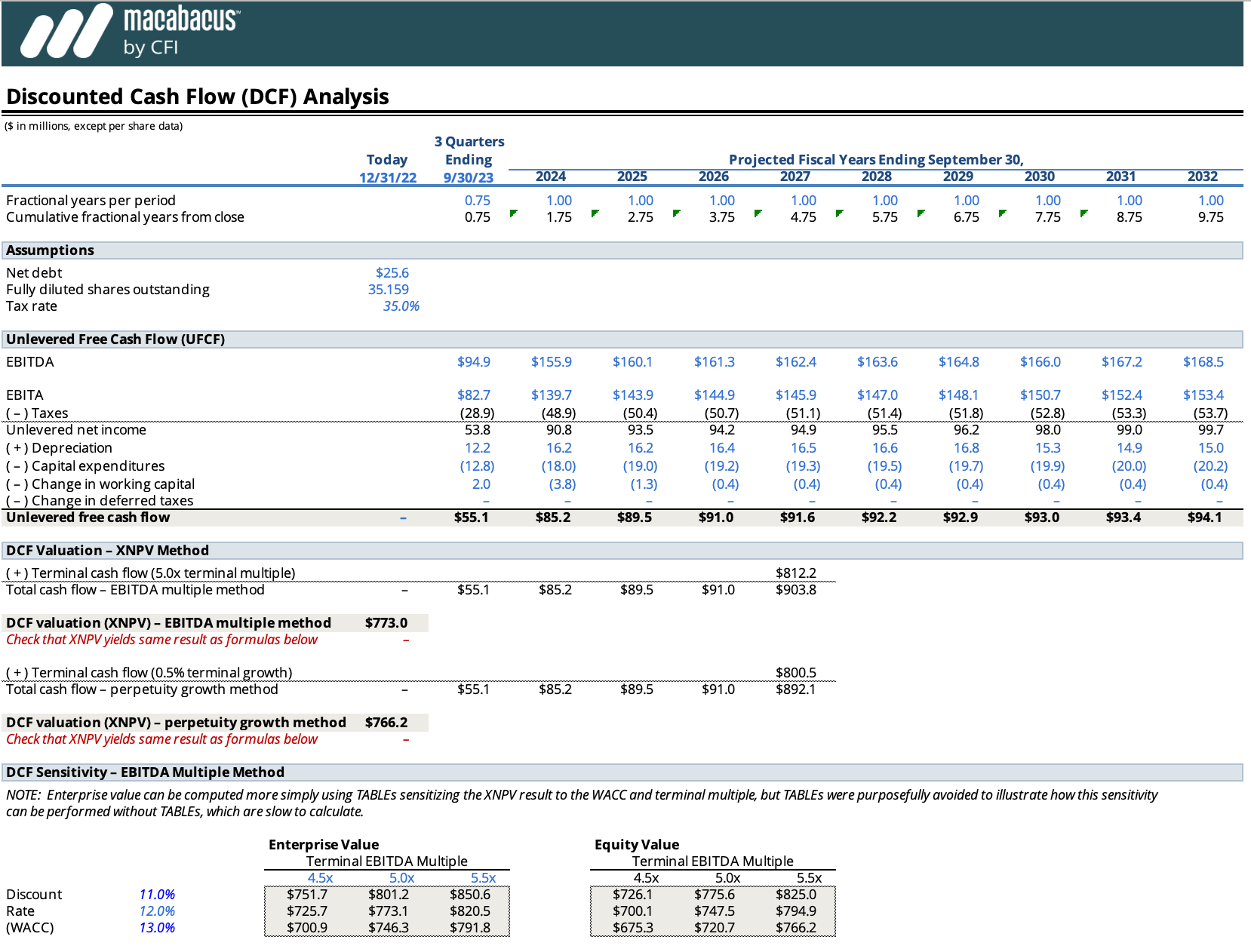

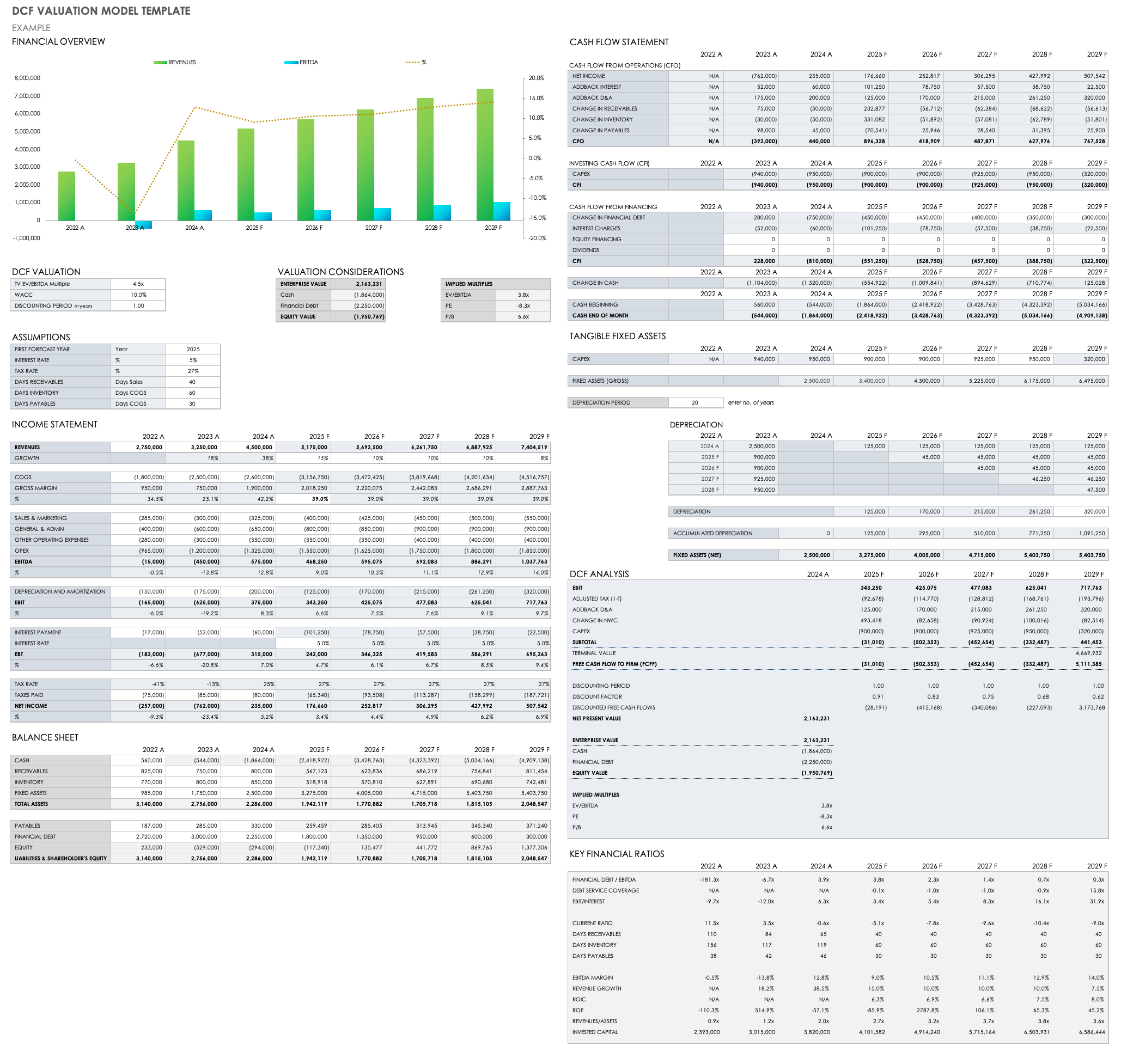

DCF Model Excel Free Template Macabacus

Calculate the implied growth rate needed to. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Instead of projecting future cash flows to. The reverse dcf calculator inverts the traditional approach of estimating a.

Пример dcf модели в excel Word и Excel помощь в работе с программами

Calculate the implied growth rate needed to. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Instead of projecting future cash flows to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free.

Navigate Your Success How to Calculate a DCF in Excel

Instead of projecting future cash flows to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash.

Mastering DCF Analysis for Investment Banking Interviews CFI

In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free reverse.

Free Reverse DCF Calculator Reverse Discounted Cash Flow Valuation

The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Instead of projecting future cash flows to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. Calculate the implied growth rate.

Dcf Model Template

Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Instead of projecting future cash flows to. Calculate the implied growth rate needed to. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value.

Instead Of Projecting Future Cash Flows To.

The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation.

Calculate The Implied Growth Rate Needed To.

In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in.