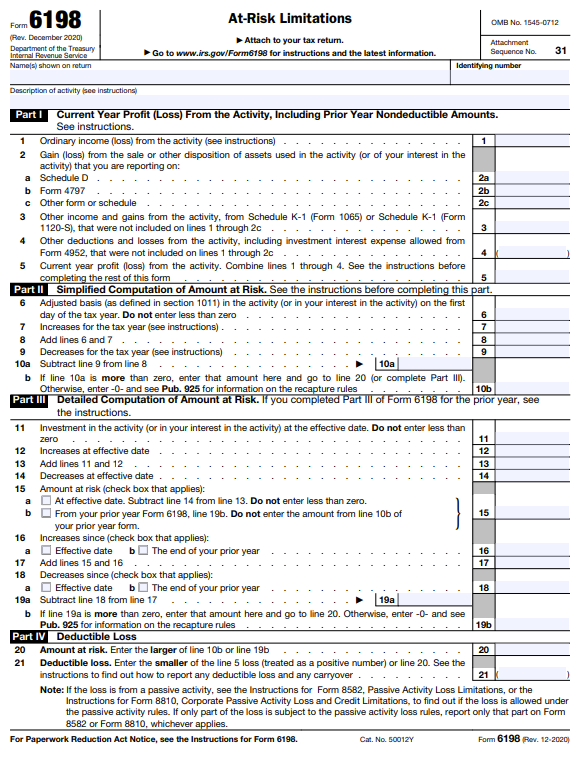

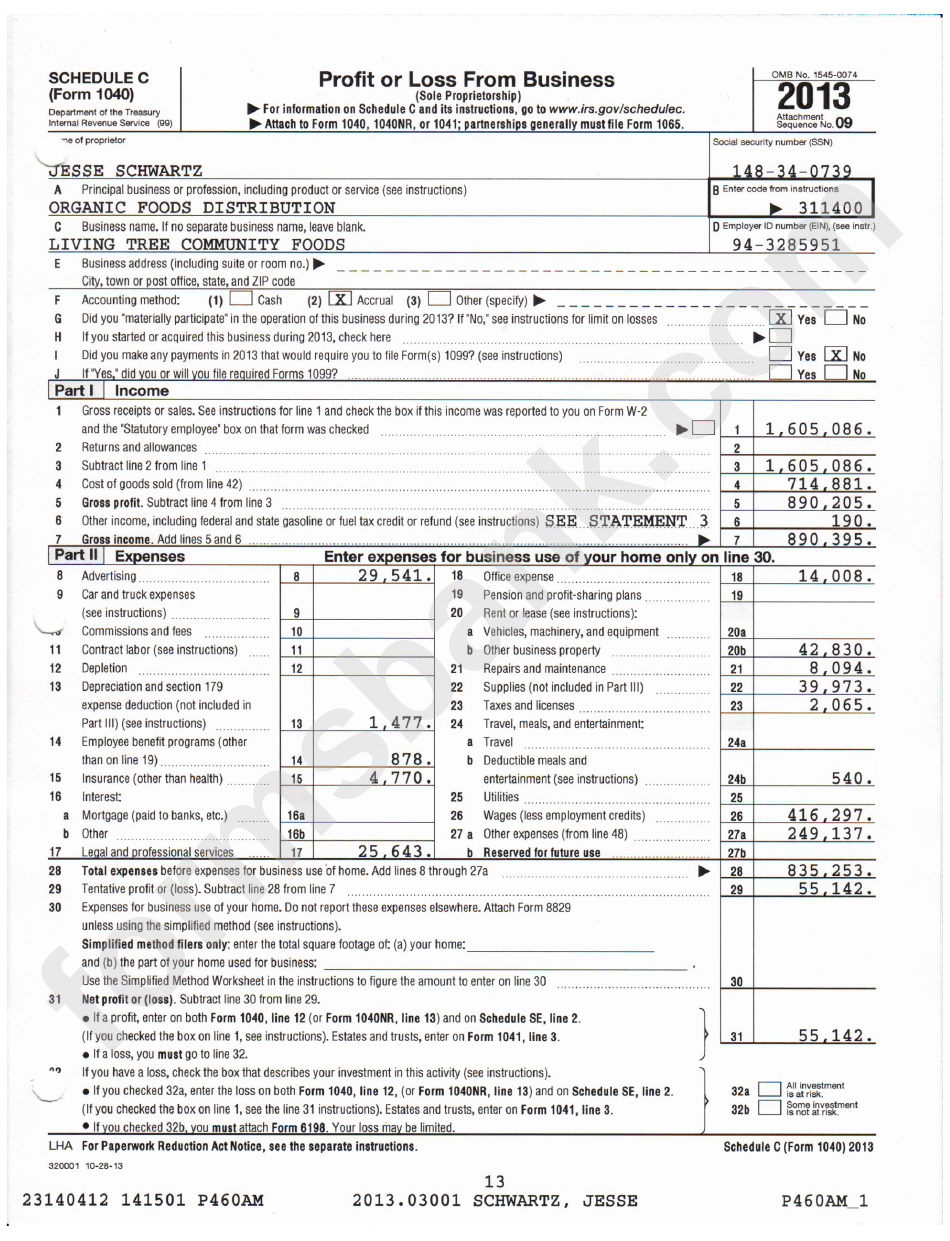

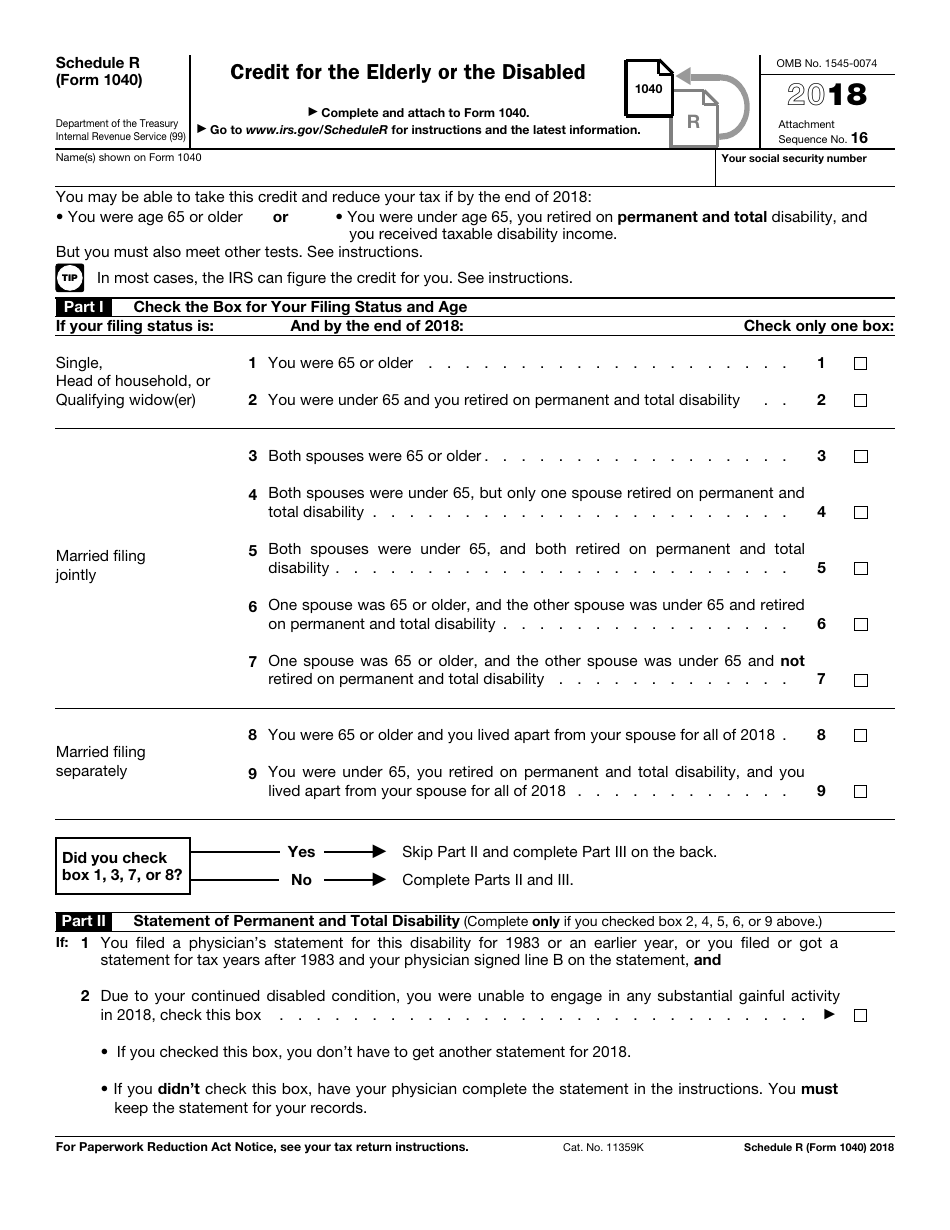

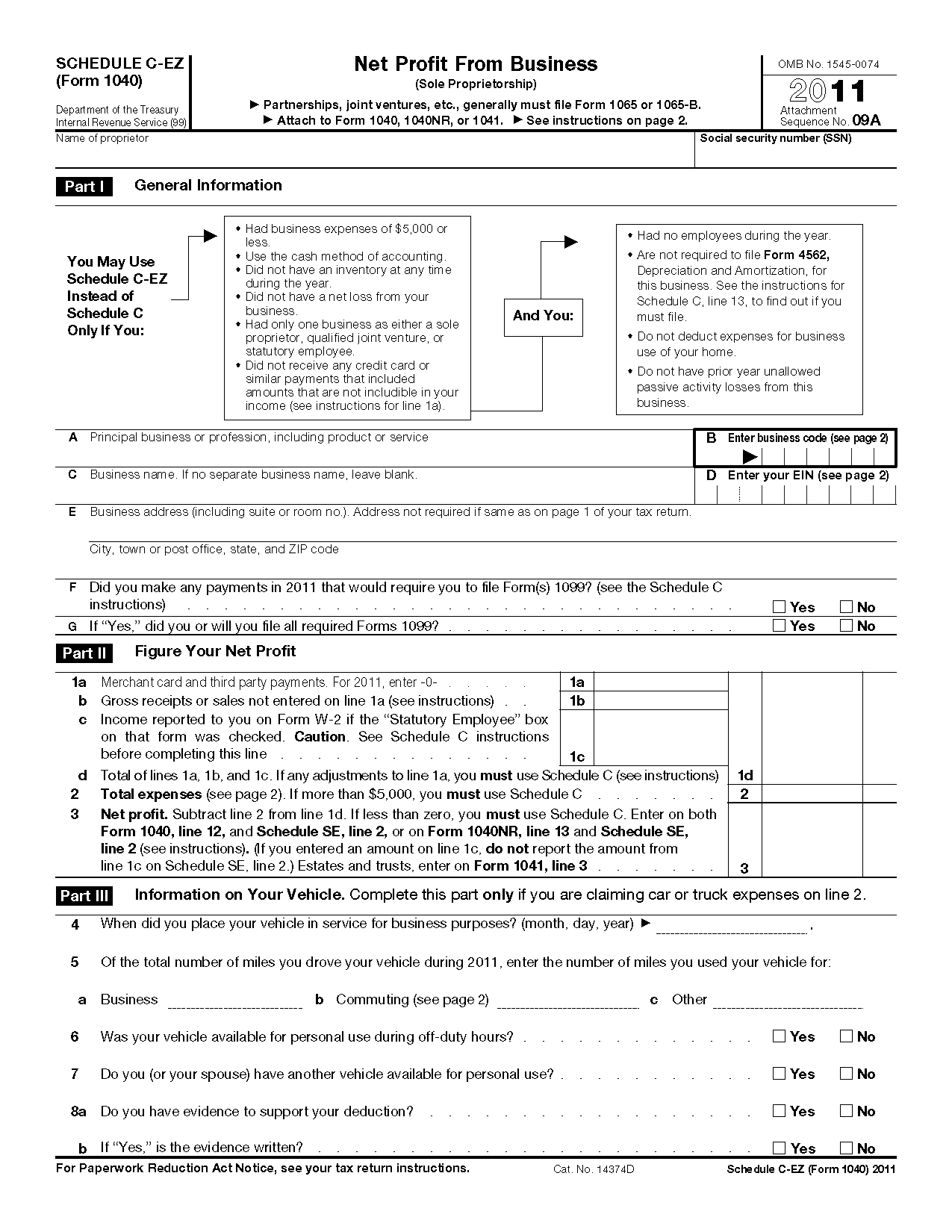

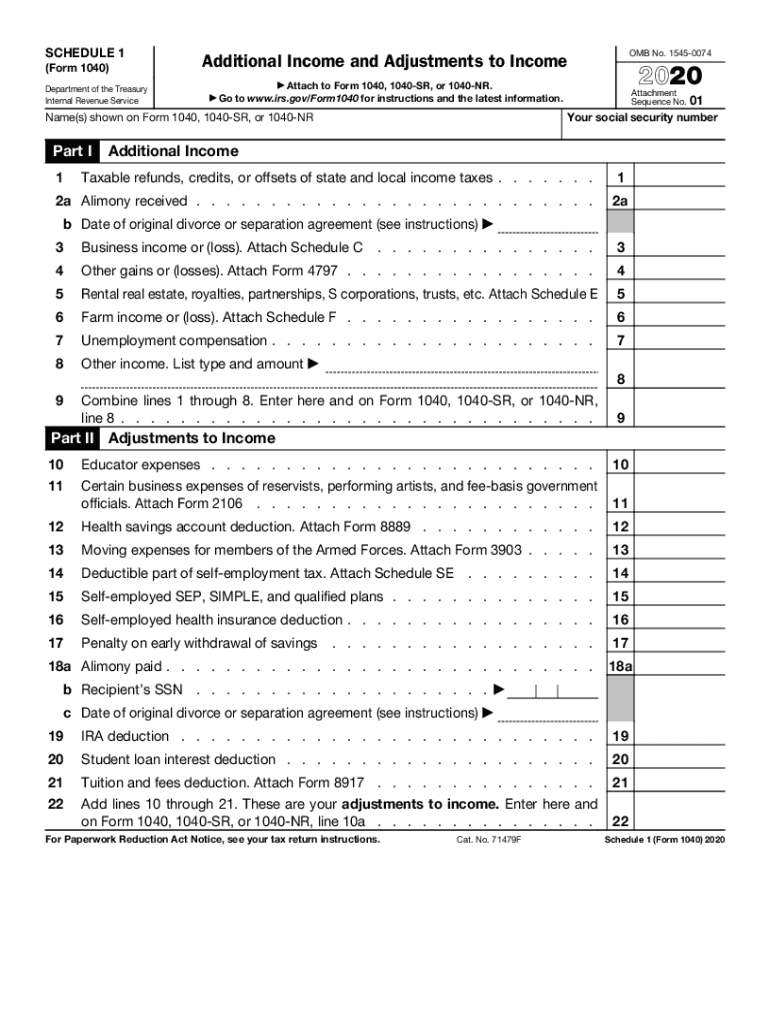

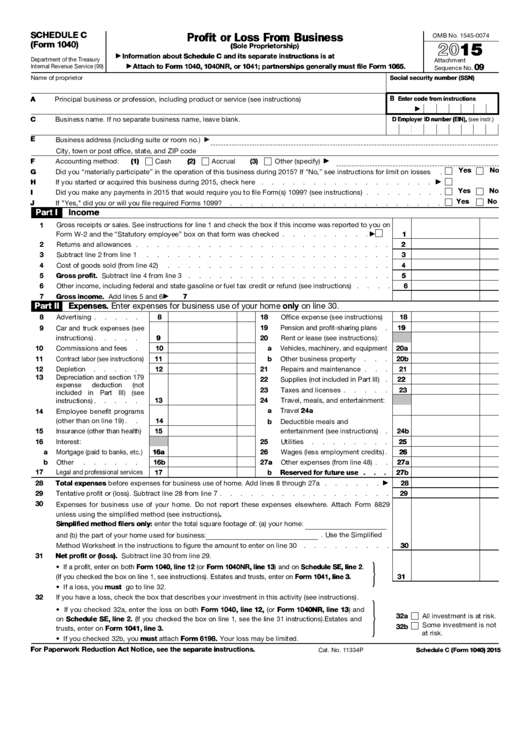

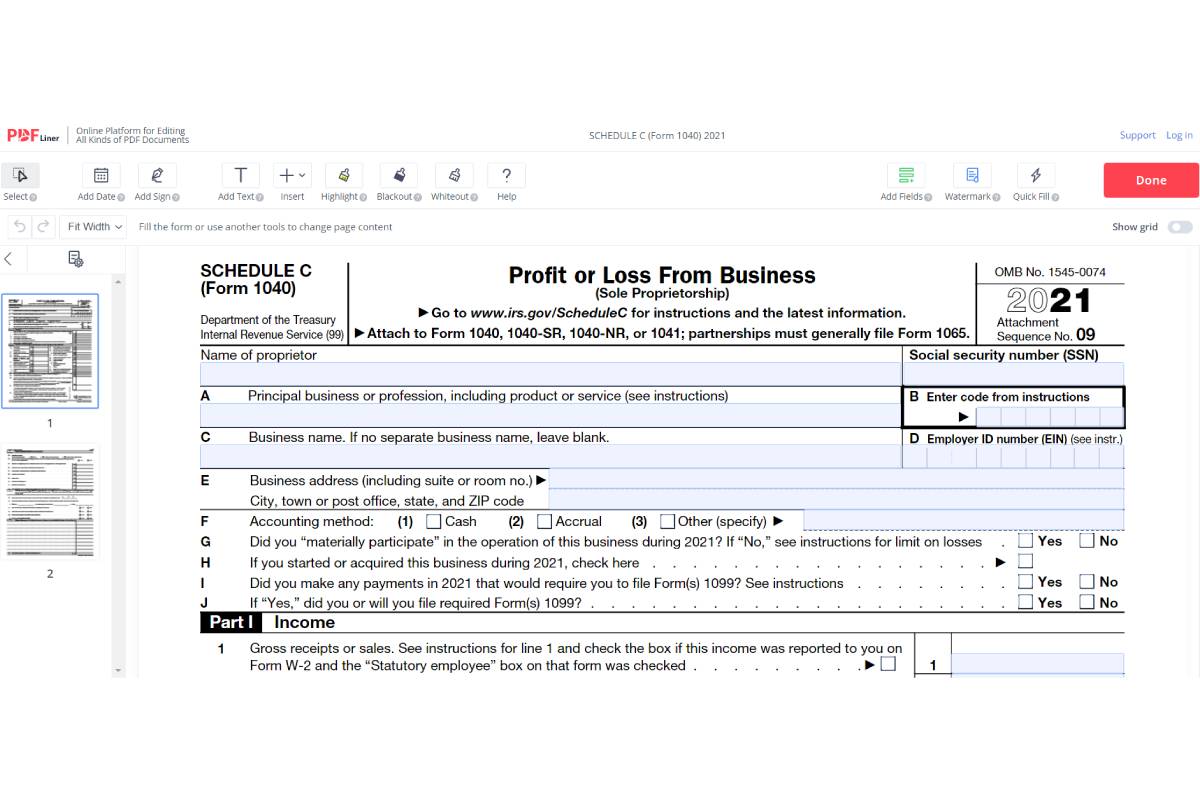

Schedule C Form Printable 2022 - Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. For real estate transactions, be sure to. Accurate asset valuationconvenient for clients This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss.

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. For real estate transactions, be sure to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate asset valuationconvenient for clients If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss.

If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. Accurate asset valuationconvenient for clients For real estate transactions, be sure to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Fillable Schedule C Irs Form 1040 Printable Pdf Download

If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. Accurate asset valuationconvenient for clients Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession.

Irs Form 1040 Schedule C 2025 Michael Harris

For real estate transactions, be sure to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. Use schedule c (form 1040) to report income or (loss) from a.

1040 Schedule C 2022 Fillable PDF Fillable Form 2025

If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. For real estate transactions, be sure to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate asset valuationconvenient for clients Use schedule c (form 1040) to.

Schedule C Instructions for SelfEmployed to File Form 1040

This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of.

What Is Schedule C of Form 1040?

For real estate transactions, be sure to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. If you disposed of any business assets in 2022, please enter.

Schedule C (Form 1040) Fill and sign online with Lumin

For real estate transactions, be sure to. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. Information about schedule c (form 1040), profit or loss from business, used to report income or.

Form 1040 Schedule C Generator ThePayStubs

For real estate transactions, be sure to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. Accurate asset valuationconvenient for clients If you disposed of any business assets.

IRS Form 1040 Schedule C (2022) Profit or Loss From Business

This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of.

Form 1040 Schedule C Sample Profit Or Loss From Busin vrogue.co

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Accurate asset valuationconvenient for clients This form helps individuals calculate their total business.

Fillable Schedule C Irs Form 1040 Printable Pdf Download

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. For real estate transactions, be sure to. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. Accurate asset valuationconvenient for clients If you disposed of any business assets.

This Form Helps Individuals Calculate Their Total Business Income, Deduct Expenses, And Determine Their Net Profit Or Loss.

For real estate transactions, be sure to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. Accurate asset valuationconvenient for clients

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)