Schedule C Worksheet 2022 - Be sure you have with you today: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please refer to the instructions for the simplified. Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c simplified method worksheet keep for your records note: Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your.

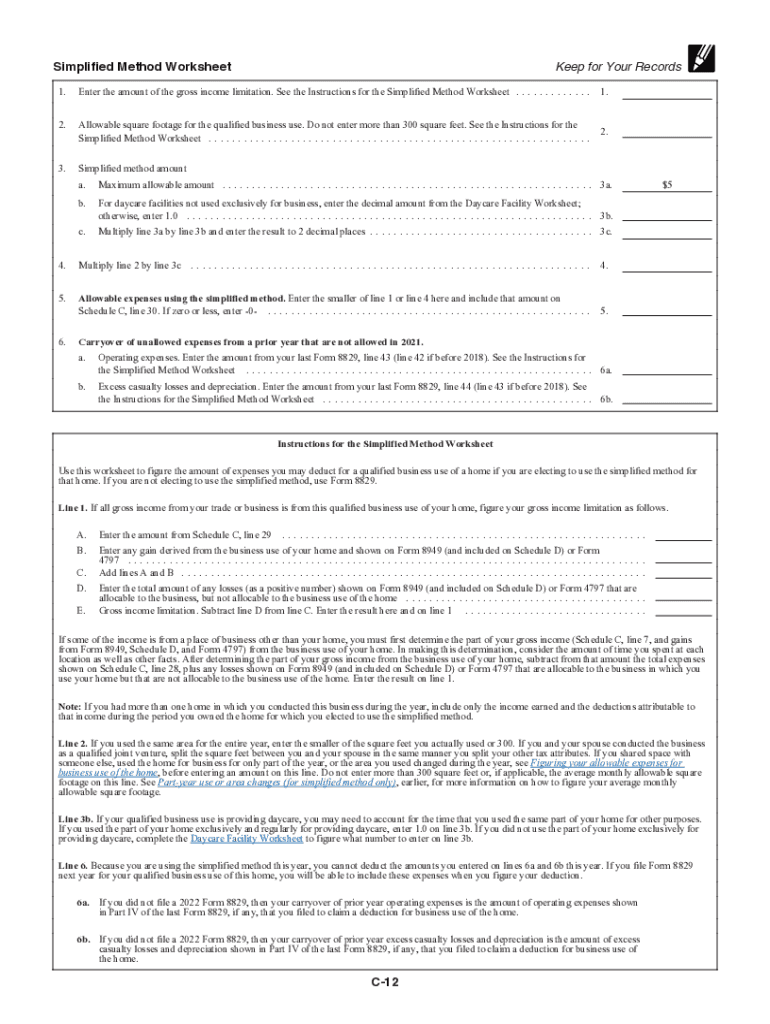

2022 schedule c simplified method worksheet keep for your records note: Attached is a blank worksheet if this is a new factor in your tax situation. Please refer to the instructions for the simplified. Be sure you have with you today: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your.

Be sure you have with you today: Please refer to the instructions for the simplified. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. 2022 schedule c simplified method worksheet keep for your records note:

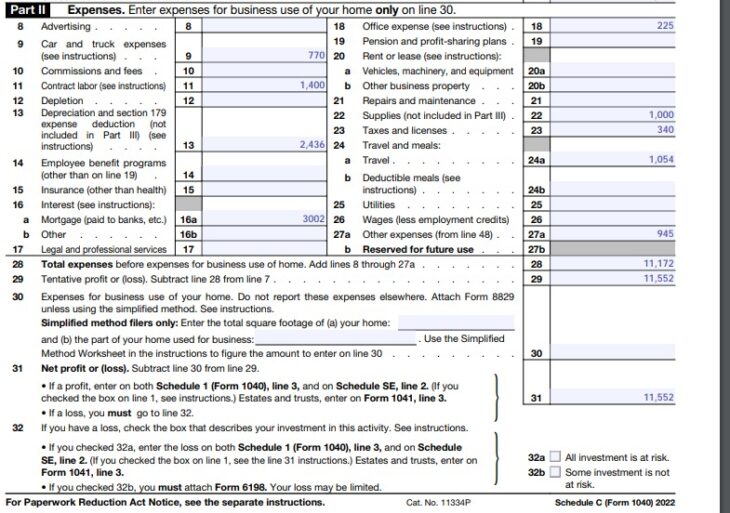

IRS Form 1040 Schedule C (2022) Profit or Loss From Business

Attached is a blank worksheet if this is a new factor in your tax situation. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Be.

Schedule c expenses worksheet Fill out & sign online DocHub

Please refer to the instructions for the simplified. Be sure you have with you today: 2022 schedule c simplified method worksheet keep for your records note: 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Attached is a blank worksheet if this is a new.

Schedule C Simplified Method Worksheet Printable And Enjoyable Learning

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c summary worksheet if you have your own business, it is important.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

Be sure you have with you today: 2022 schedule c simplified method worksheet keep for your records note: Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Net profit or.

Free Printable Schedule C Tax Form

2022 schedule c simplified method worksheet keep for your records note: Attached is a blank worksheet if this is a new factor in your tax situation. Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 2022 schedule c.

How To Fill Out Your 2022 Schedule C (With Example)

Be sure you have with you today: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. 2022 schedule c simplified method worksheet keep for your.

How to Fill Out Your Schedule C Perfectly (With Examples!) Worksheets

2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Attached is a blank worksheet if this is a new factor in your tax situation. Net profit or (loss) buildings and machinery sold outright (no trades): Please refer to.

Schedule C Expenses Worksheet 2022

Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please refer to the instructions for the simplified. Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c simplified method worksheet.

1040 schedule c 2022 form Fill out & sign online DocHub

2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please refer to the instructions for the simplified. Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c summary worksheet if.

Schedule C Printable Guide

2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. 2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please refer to the instructions.

Attached Is A Blank Worksheet If This Is A New Factor In Your Tax Situation.

Please refer to the instructions for the simplified. Be sure you have with you today: 2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.

2022 Schedule C Summary Worksheet If You Have Your Own Business, It Is Important That You Maintain Proper Books And Records Of Both Your.

Net profit or (loss) buildings and machinery sold outright (no trades):

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)