Vat Filing Charges In Uae - If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. Learn about the 5% vat. However, businesses may incur additional. To check the penalties amount and complete the. Vat registration in the uae is free of charge when done through the fta portal. Complete guide to vat compliance for uae businesses:

However, businesses may incur additional. To check the penalties amount and complete the. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. Learn about the 5% vat. Vat registration in the uae is free of charge when done through the fta portal. Complete guide to vat compliance for uae businesses:

Vat registration in the uae is free of charge when done through the fta portal. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. Complete guide to vat compliance for uae businesses: However, businesses may incur additional. To check the penalties amount and complete the. Learn about the 5% vat.

How to File VAT Returns in UAE? A stepbystep VAT Returns User Guide

Vat registration in the uae is free of charge when done through the fta portal. Learn about the 5% vat. However, businesses may incur additional. Complete guide to vat compliance for uae businesses: If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply.

StepbyStep Guide to Filing VAT Return in UAE

However, businesses may incur additional. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. To check the penalties amount and complete the. Vat registration in the uae is free of charge when done through the fta portal. Learn about the 5% vat.

What is UAE VAT Reverse Charge and How it works

Learn about the 5% vat. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. To check the penalties amount and complete the. However, businesses may incur additional. Complete guide to vat compliance for uae businesses:

Procedure of VAT Return Filing in Dubai

However, businesses may incur additional. Learn about the 5% vat. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. Vat registration in the uae is free of charge when done through the fta portal. To check the penalties amount and complete the.

StepbyStep Guide to Filing VAT Return in UAE

If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. Vat registration in the uae is free of charge when done through the fta portal. To check the penalties amount and complete the. Learn about the 5% vat. Complete guide to vat compliance for uae businesses:

A Brief Guide on UAE VAT Filling Process AKA

However, businesses may incur additional. Learn about the 5% vat. To check the penalties amount and complete the. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. Vat registration in the uae is free of charge when done through the fta portal.

VAT Filing in UAE, Dubai VAT Return UAE VAT Submissions

Learn about the 5% vat. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. Complete guide to vat compliance for uae businesses: To check the penalties amount and complete the. However, businesses may incur additional.

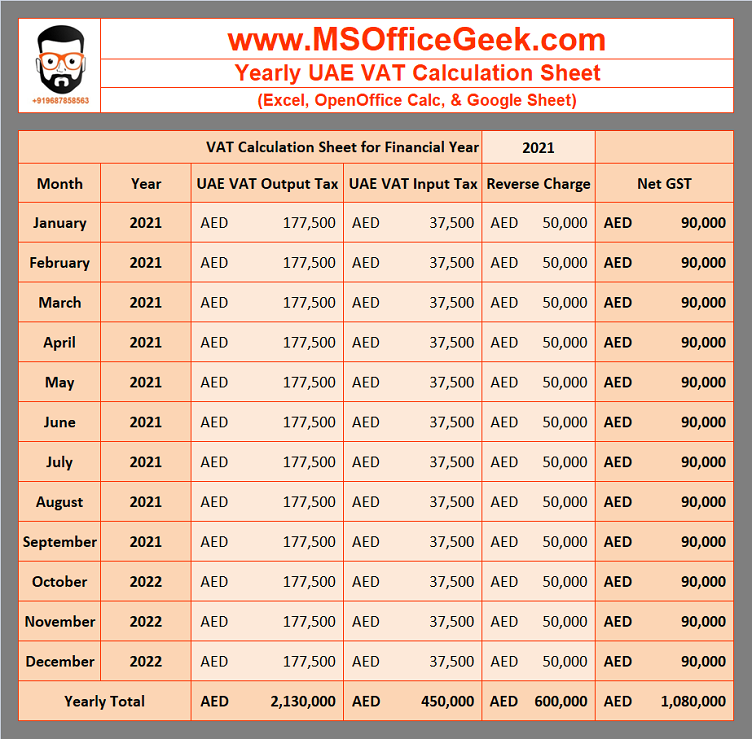

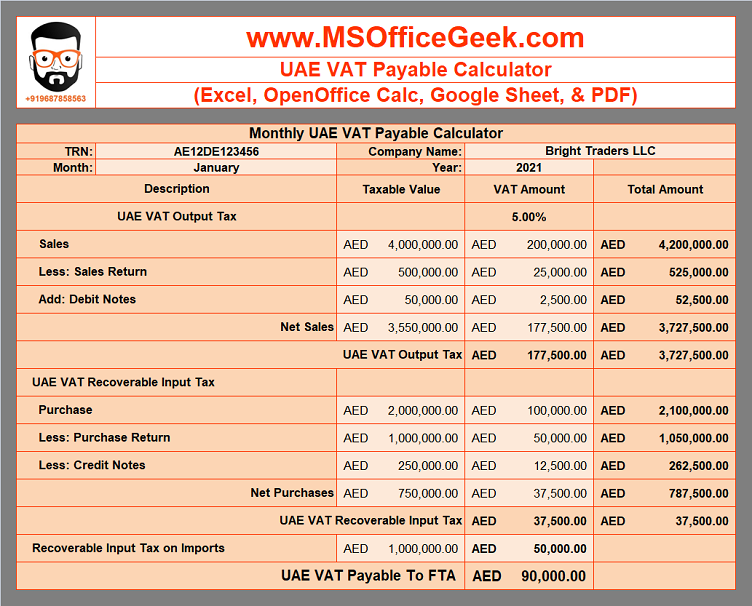

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

To check the penalties amount and complete the. Vat registration in the uae is free of charge when done through the fta portal. Complete guide to vat compliance for uae businesses: Learn about the 5% vat. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply.

A StepByStep Guide On VAT Filing in UAE Tulpar Global Taxation

Complete guide to vat compliance for uae businesses: However, businesses may incur additional. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. Learn about the 5% vat. Vat registration in the uae is free of charge when done through the fta portal.

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

However, businesses may incur additional. Vat registration in the uae is free of charge when done through the fta portal. Learn about the 5% vat. To check the penalties amount and complete the. Complete guide to vat compliance for uae businesses:

Vat Registration In The Uae Is Free Of Charge When Done Through The Fta Portal.

To check the penalties amount and complete the. If you fail to file your vat return on time or to pay your vat return on time, a penalty will apply. Learn about the 5% vat. However, businesses may incur additional.